Download the full report as a PDF now.

We've seen healthy asking prices, but not enough houses during the month of February. Vendors are starting to get active around the country, but it might be time to give up the quarter-acre dream. We saw 13-year highs seen in five of our 19 regions.

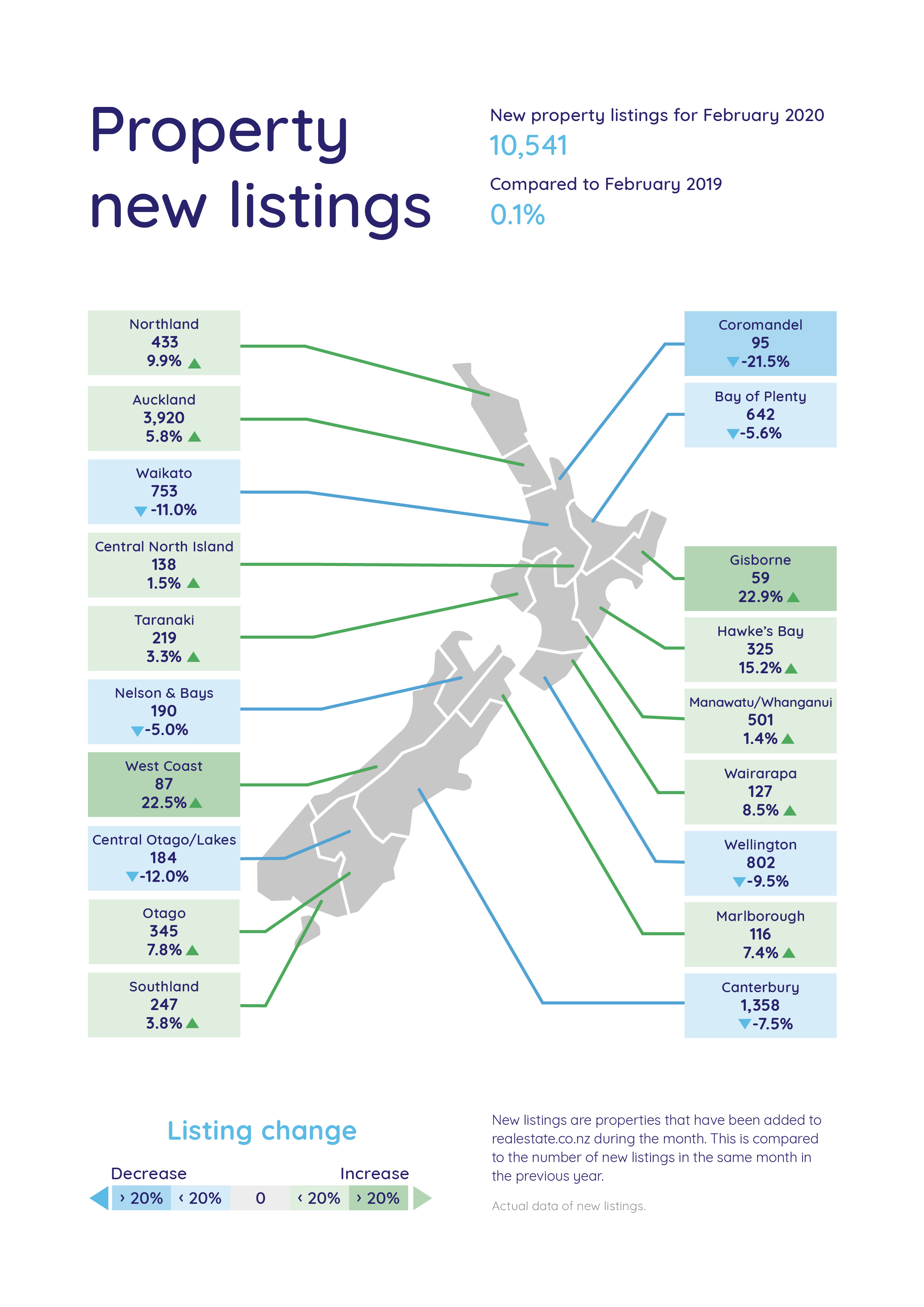

Real-time data from realestate.co.nz shows that New Zealand is still facing a serious stock shortage, with 22.3% less total homes available for sale last month when compared to February 2019.

Healthy asking prices and all-time highs in five regions are likely being driven by this stock shortage and Vanessa Taylor, spokesperson for realestate.co.nz, suggests that it might be time that Kiwis looked at alternatives to the quarter-acre dream with our ever-changing ‘lock up and leave’ lifestyles.

There is certainly hope for buyers in some parts of New Zealand, however. Vendors were active last month with 12 of 19 regions seeing an increase in new listings coming onto the market compared to the same month in 2019. This is despite new listings being flat nationally.

Asking price highs in five regions

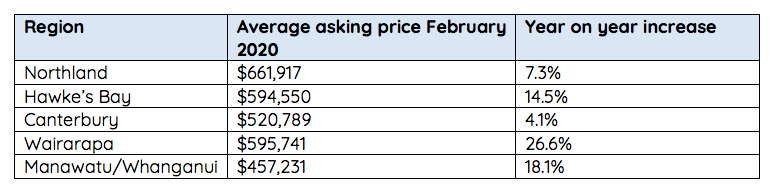

The national average asking price, which tipped $700,000 for the first time in December 2019, slid back marginally in February to $702,510. Real-time data from realestate.co.nz shows that despite a decrease on January 2020, the national average asking price is still 4.0% higher than February last year.

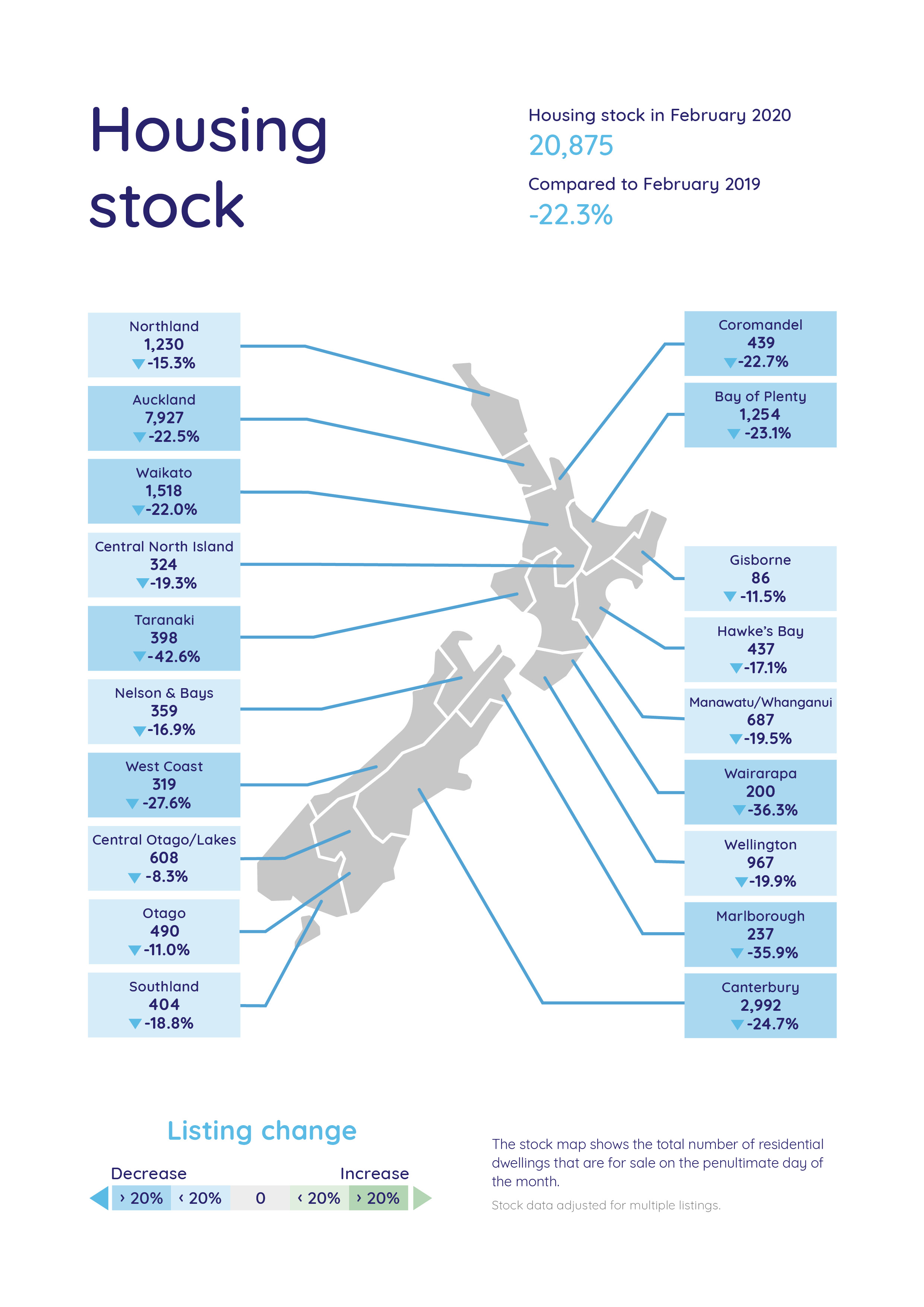

Asking prices were also up in Northland, Hawke’s Bay, Canterbury, Wairarapa and Manawatu/Whanganui with these regions reaching all-time highs since records began 13 years ago.

In the Wairarapa, prices were an impressive 26.6% higher last month than in February 2019. Despite some price spikes last year, the average asking price in the region has been on an upward trajectory since September 2019.

“The majority of people seeking property in the Wairarapa are Wellington-based, but we are also seeing a lot of people from Auckland and the Hawke’s Bay viewing property listings in the area.”

“Perhaps Hawke’s Bay wine lovers are looking to put down roots in the relatively young, boutique wine region in 2020,” says Vanessa.

Vendors getting active around the country

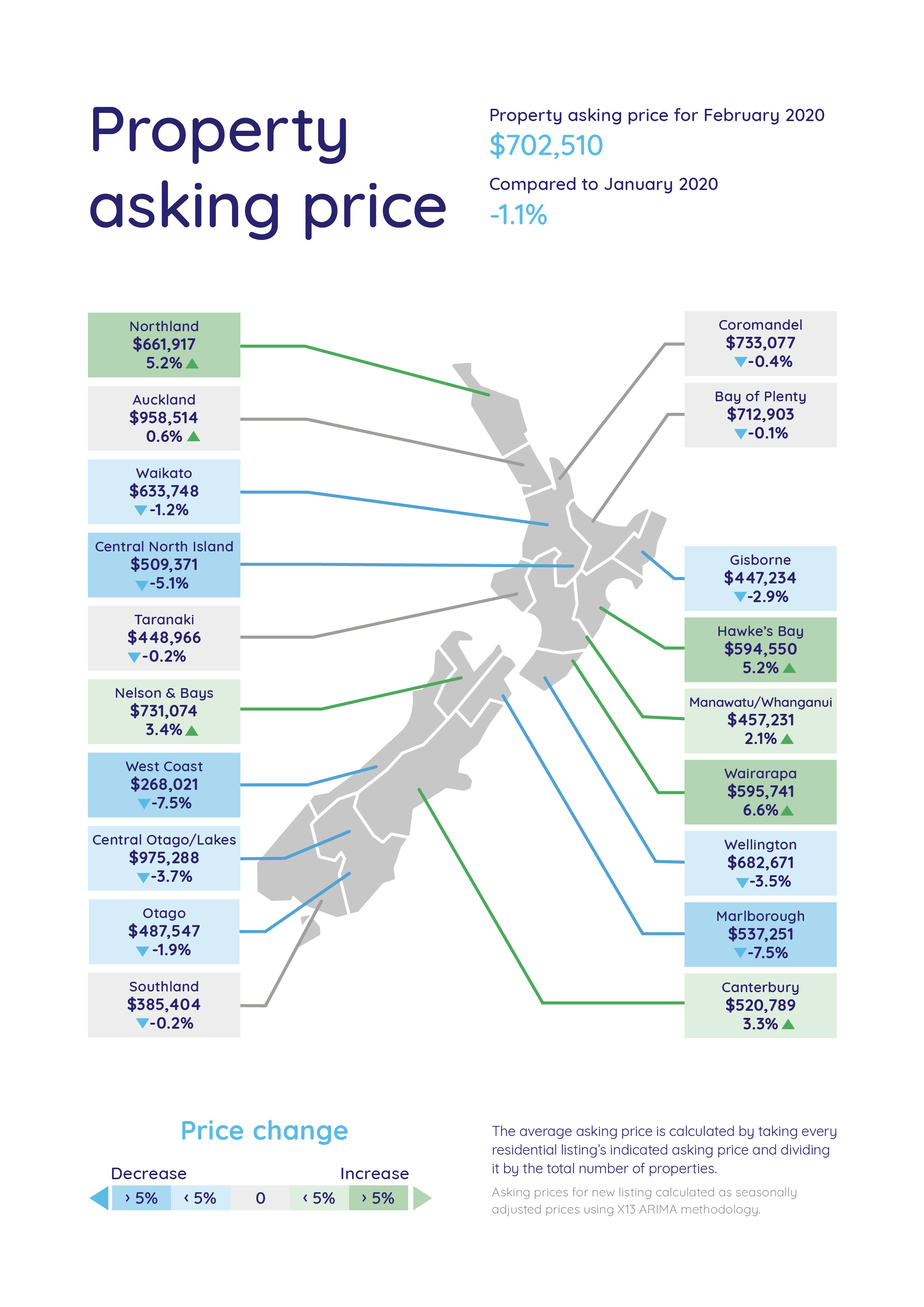

New listings coming onto the market were flat nationally last month, however we did see new listings increase in some regions.

Following on from the rumblings of new listings activity we saw in the middle of the North Island in January, data from realestate.co.nz shows that vendors were busy putting their homes on the market in February.

“12 of our 19 regions saw a lift in new listings last month compared to the same time last year, so although we still have a very real shortage of homes for sale around the country, it is encouraging to see pockets of New Zealand getting active in 2020,” says Vanessa.

The most significant increases were seen in Gisborne, the West Coast and the Hawke’s Bay who saw increases of 22.9%, 22.5% and 15.2% respectively compared to February 2019.

Bindi Norwell, Chief Executive at the Real Estate Institute of New Zealand says:

“With increasing confidence levels across the country from first time buyers, investors and owner-occupiers, it’s great to see more listings come to the market – particularly in areas where there has been a significant shortage of properties over the last few months. We look forward to seeing how this increase of new listings plays out.”

But short supply remains an issue

Despite some increases to new listings, total property for sale remains in short supply around the country.

In Auckland, there were 22.5% fewer homes available compared to the same time last year and this decrease was mirrored in other regions.

Marlborough reached an all-time low since records began 13 years ago with 35.9% fewer homes available when compared to February 2019. In Taranaki and Wairarapa, total stock was down by 42.6% and 36.3% respectively - the biggest year on year decreases seen in any region during February.

Vanessa speculates that New Zealand’s lack of housing could be due to the Global Financial Crisis (GFC) which saw a slump in the building industry. She says this is the biggest challenge in the property market right now.

“In about 2004, New Zealand started to really see an increase in the number of new dwellings being built. We weren’t quite keeping up with population growth, but we were certainly taking steps in the right direction.”

“When the GFC hit, we stopped building and now we are experiencing the hangover from this quiet period and are struggling to meet the demand for housing,” says Vanessa.

Healthy property prices around the country are likely being driven by this lack of supply.”

“This might be good news for sellers, but it presents real challenges for a growing country like New Zealand,” says Vanessa.

Is it time to give up the quarter-acre dream?

Building homes that are designed for the modern Kiwi, says Vanessa, might be a solution to our critical housing shortage.

“Our lives look very different to those of our grandparents, but we are still living in homes that were designed for the lives they led.”

“Most Kiwis are becoming increasingly time-poor. We are looking for ways to cut down our commuting times and we don’t want to spend our precious weekends on housework and garden maintenance,” says Vanessa.

High-quality, high-density housing is a global solution that could have great success here, but we first need to change the psyche of Kiwis – many of whom are hanging on to the quarter-acre dream, says Vanessa.

“People want affordability and homes that support their lifestyles. I think we will see a shift in the sorts of homes being built and in how developers start to present the ‘back garden’ that Kiwis love so much.”

Vanessa suggests that changing our housing ideals might also help us to increase the efficiency of our housing model.

“We have a lot of builders that build three or four homes per year. If we start to look at how the building market can better supply modern New Zealanders, I think we will find new opportunities to scale up,” says Vanessa.

For media enquiries, please contact:

Trish Fitzsimons | 021 022 96927 | trish@realestate.co.nz

Glossary of terms:

As the only provider of real estate data in real-time, realestate.co.nz offers valuable property market information not available from other sources.

- Average asking price is not a valuation. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released at the same time.

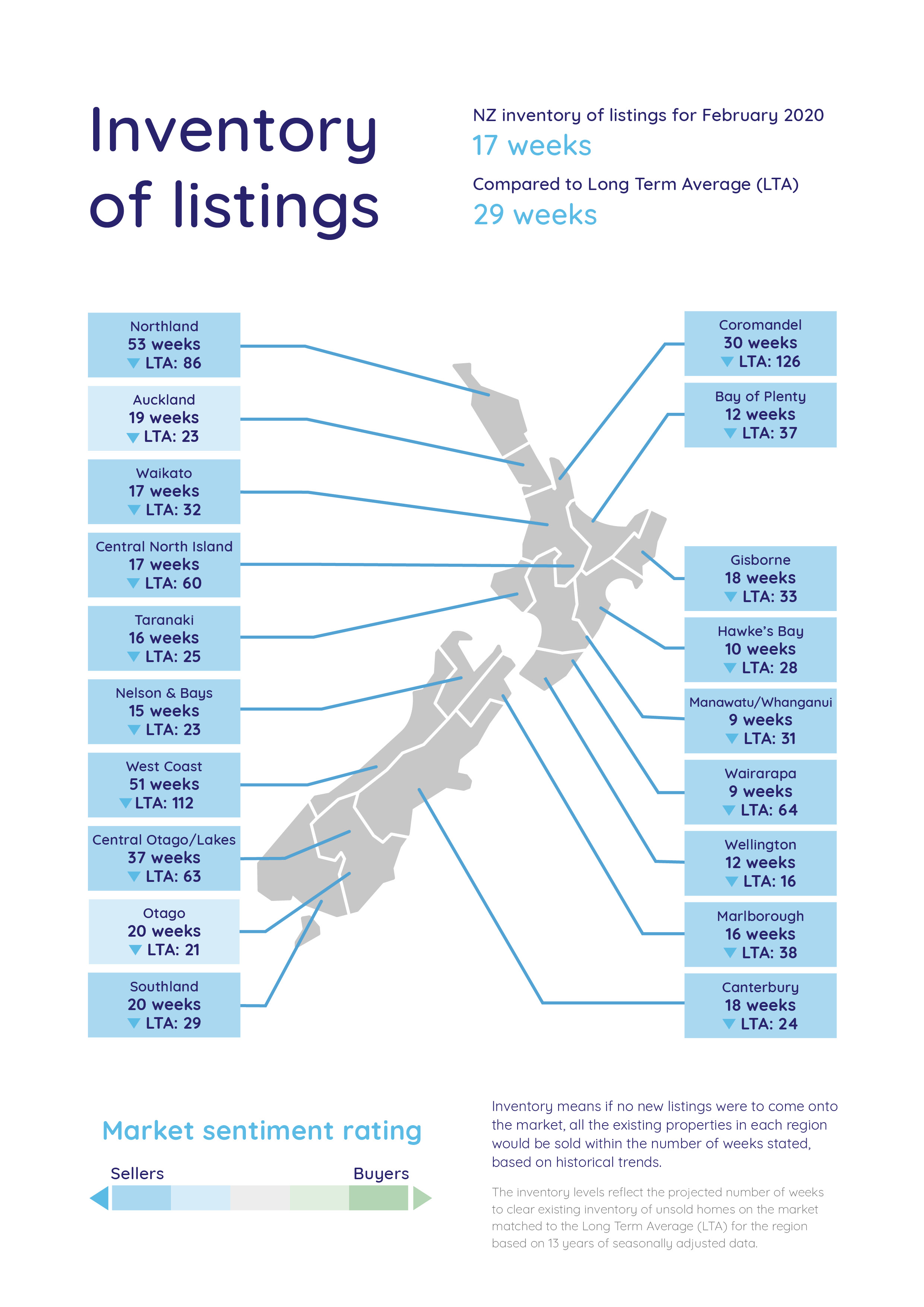

- Inventory is a measure of how long it would take, theoretically, to sell the current stock at current average rates of sale if no new properties were to be listed for sale. It provides a measure of the rate of turnover in the market.

- New listings are a record of all the new listings on realestate.co.nz for the relevant calendar month. As realestate.co.nz reflects 97% of all properties listed through registered estate agents in New Zealand, this gives a representative view of the New Zealand property market.

- Demand: the increase or decrease in the number of views per listing in that region, taken over a rolling three-month time frame, compared to the same three-month time frame the previous year – including the current month.

- Seasonal adjustment is a method realestate.co.nz uses to better represent the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

- Truncated mean is the method realestate.co.nz uses to provide statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated, to prevent exceptional listings from providing false impressions.

02 Mar 2020