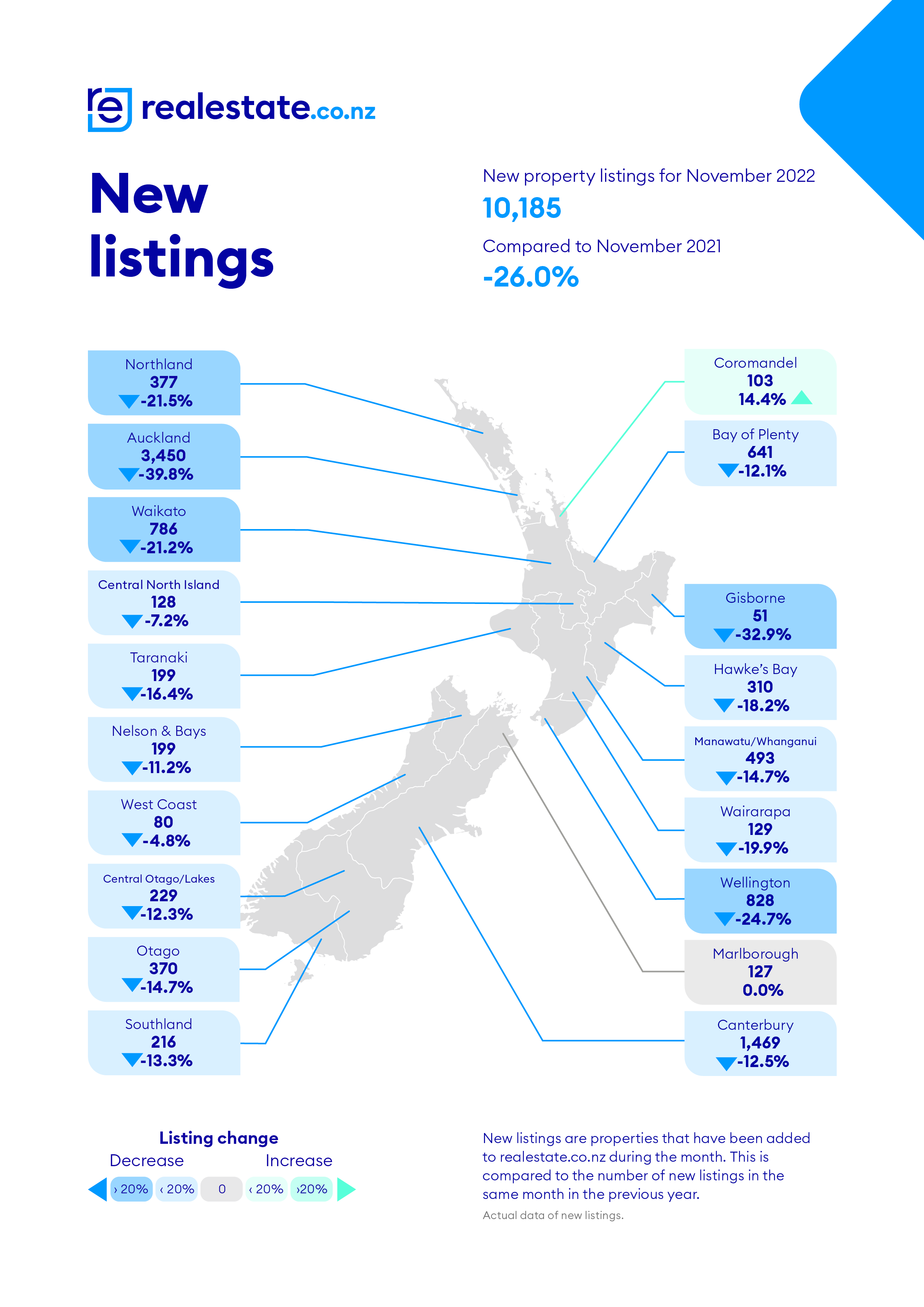

Vendors shied away from listing their properties for sale last month, with the latest data from realestate.co.nz showing new listings were down by 26.0% in November 2022 compared to November 2021.

The dip in new listings comes as the official cash rate (OCR) rose for the ninth consecutive month. Vanessa Williams, spokesperson for realestate.co.nz, says Kiwis seem more hesitant to put their homes on the market in the current climate:

“Rising interest rates mean less credit is available for Kiwis looking to buy. As a result, we have seen house prices trend downwards, likely impacting those looking to sell.”

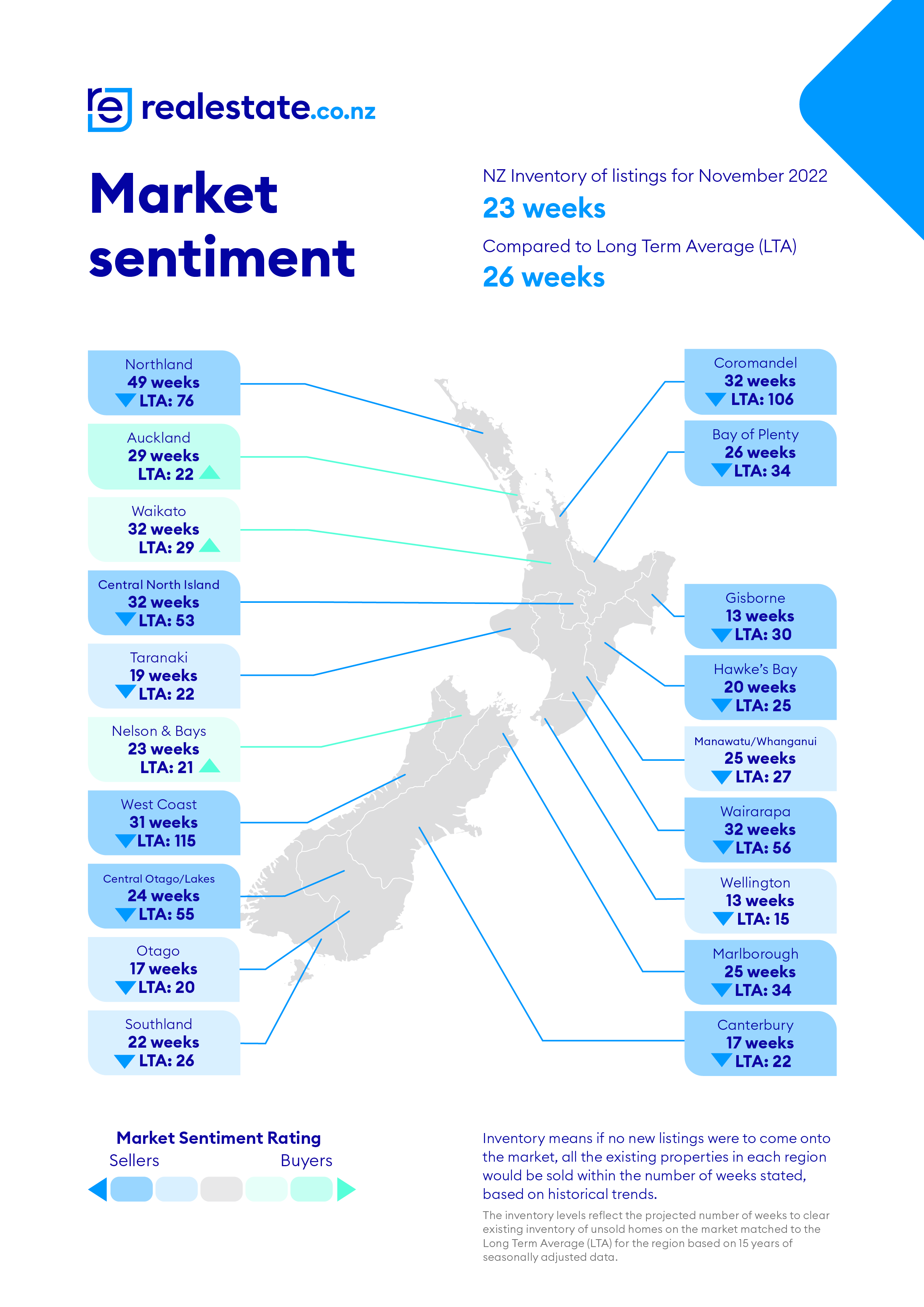

She says the market is continuing to slow, with properties generally staying on the market longer than they did a year ago. But she notes that demand remains steady – the number of people searching for property at realestate.co.nz increased by more than 5% between October 2022 and November 2022.

“There are still good opportunities for buyers and sellers alike in the current market. Sellers may just need to adjust their price expectations and be prepared to negotiate.”

“Property is a long-term investment. We may be seeing a dip in prices now, but the national average asking price was still up by more than $200,000 or 31.0% last month compared to November 2019,” says Vanessa.

She adds that these long-term price increases are even more marked if you look back five or ten years.

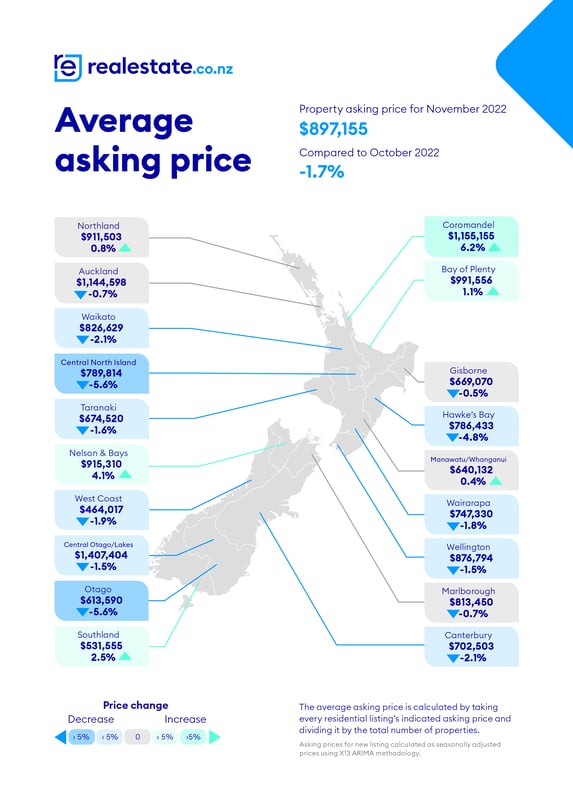

Average asking prices reflect a continued slowing in the market

After peaking at $992,832 in January 2022, in November, the national average asking price fell below $900,000 for the first time since mid-2021. This is a decline of around $10,000 per month. “As we predicted in October, we might just see the national average asking price sitting around $890,000 by the end of 2022,” says Vanessa.

“As we predicted in October, we might just see the national average asking price sitting around $890,000 by the end of 2022,” says Vanessa.

The national average asking price was also down by -8.4% or $82,083 in November 2022 compared to November 2021.

Despite this overall decline, four regions saw their average asking price increase on October 2022. Bay of Plenty was up 1.1% to $991,556, Nelson and Bays jumped 4.1% to $915,310, Southland increased 2.5% to $531,555, and Coromandel bumped up by 6.2% to $1,155,155.

“In November, Nelson & Bays also tipped into a buyers’ market, so seeing an increase to the average asking price in this region may surprise some people.”

“However, a buyers’ market doesn’t mean bargain basement prices – it is an indicator of turnover in the market. Right now, properties are taking longer to sell in this region than they have on average over the last 15 years since records began,” explains Vanessa.

Is stock growth peaking?

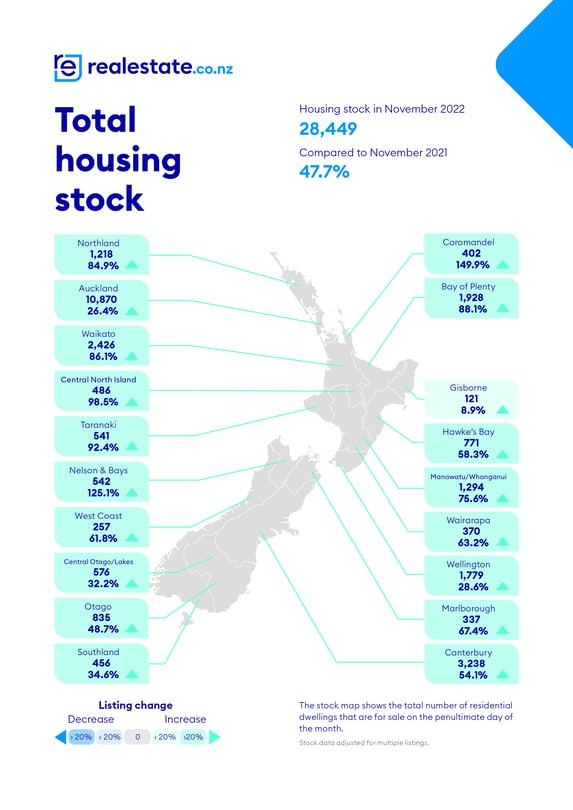

Stock numbers have risen significantly throughout 2022, but the latest figures from realestate.co.nz suggest this growth might be slowing.

In July and August 2022, national stock levels more than doubled year-on-year (up 107.8% and 107.7%, respectively). Comparatively, stock increased by a more conservative 47.7% in November 2022.

“Since September, the growth rate has been declining, suggesting we might be on the other side of a stock peak.”

“I think we are still a way out from seeing stock levels decline, but if stock growth begins to decelerate, it will likely have a wider impact on the market. It comes down to supply and demand,” says Vanessa.

However, while stock growth appears to be easing, there are still some regions where, compared to November 2021, stock has doubled or been close to doubling.

The most notable year-on-year stock increases were in Coromandel (up 149.9%), Nelson & Bays (up 125.1%), Central North Island (up 98.5%), and Taranaki (up 92.4%)

Sitting well below other regions with just an 8.9% rise, Gisborne interestingly saw the smallest year-on-year stock increase in November 2022.

Inflation, interest rate increases and fears of a looming recession are all factors impacting the property market. Vanessa says that while there will always be speculation around ‘good’ and ‘bad’ times to buy or sell, it comes down to personal circumstances.

Inflation, interest rate increases and fears of a looming recession are all factors impacting the property market. Vanessa says that while there will always be speculation around ‘good’ and ‘bad’ times to buy or sell, it comes down to personal circumstances.

‘The market is just a market. Buying or selling property is not just a transaction but a way to choose the life we want to live.”

For media enquiries, please contact:

Brigid Conroy | brigid@brainchild.co.nz | Brainchild

About realestate.co.nz

As New Zealand’s longest-standing property website, realestate.co.nz’s mission is to empower New Zealanders with a property search tool they can use to find the life they want to live. With residential, lifestyle, rural and commercial property listings, realestate.co.nz is the place to start for those looking to buy or sell property.

Whatever life you’re searching for, it all starts here.

Glossary of terms:

Average asking price (AAP) is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released simultaneously.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. The site reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

01 Dec 2022