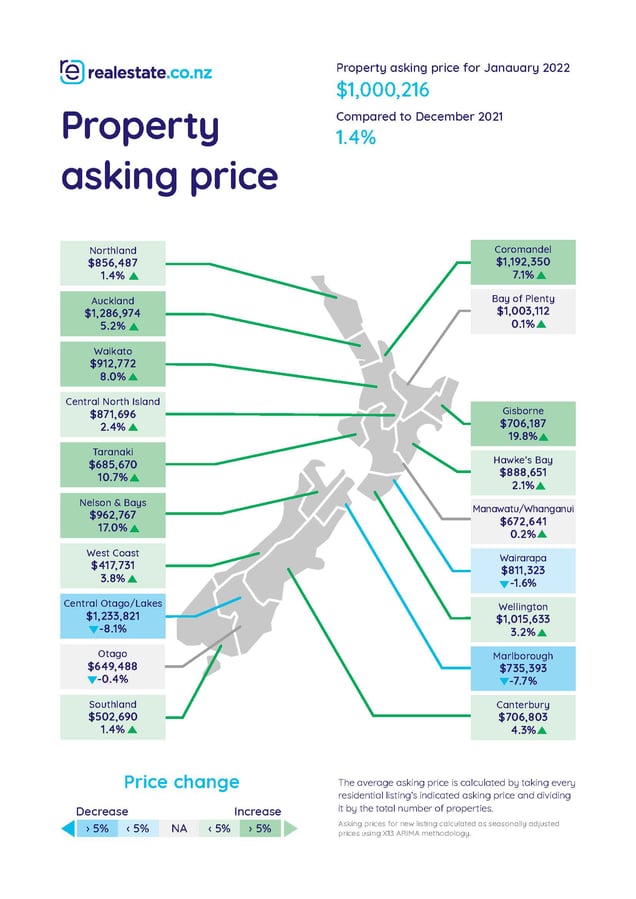

Real-time data from realestate.co.nz shows the New Zealand property market hit a major milestone in January 2022—the national average asking price is now $1,000,216.

Vanessa Williams, spokesperson for realestate.co.nz, puts the quickening pace of rising prices into perspective.

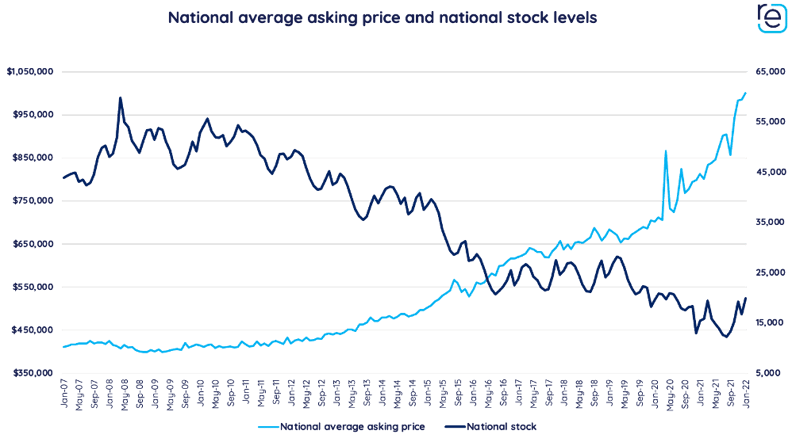

“We’ve seen the national average asking price increase consecutively for four months, and not by small measures. When we started recording data 15 years ago, the average asking price was a little over $410,000. Five years later, in January 2012, prices increased to around $420,000,” said Vanessa. “The trend was steady until mid-2015 when the average asking price breached $500,000. Since then, we’ve seen sharp increases from season to season.”

“In the last ten years, the national average asking price has increased by about $580,000—up 138.3%.”

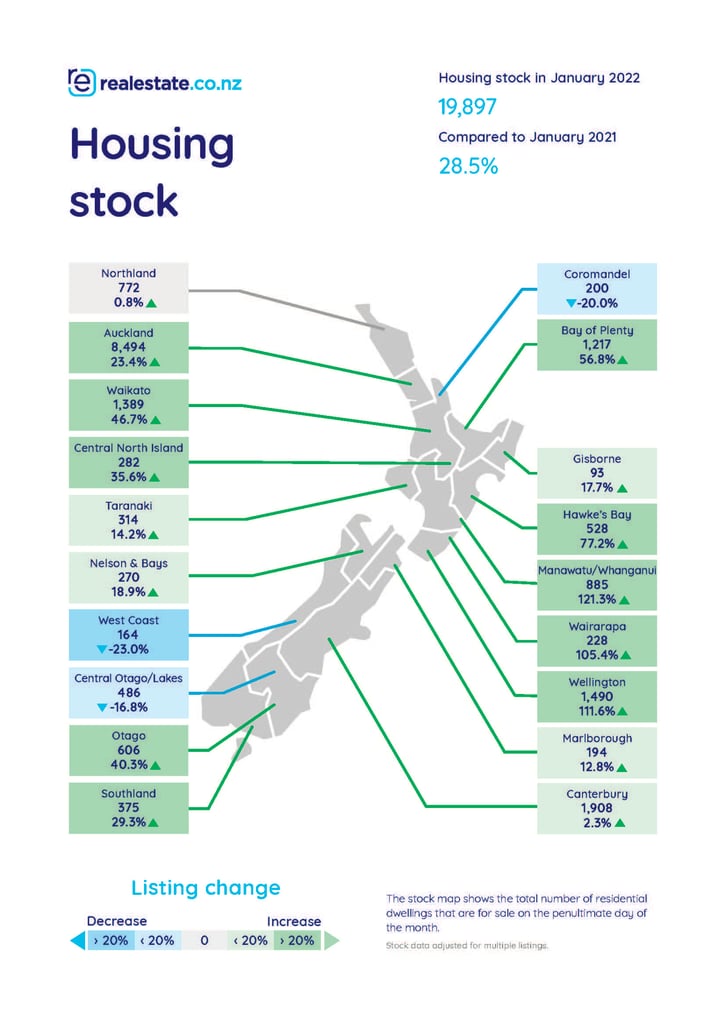

National total stock up 28.5% year-on-year, led by three regions

There were about 4,500 more homes on the market in January 2022 compared to the previous year. This was led by three regions, including Manawatu / Whanganui (up 121.3%), Wellington (up 111.6%) and Wairarapa (up 105.4%), which all saw their stock more than double year-on-year. Nearly all New Zealand’s regions saw their stock increase, save for the West Coast (down -23.0% year-on-year), the Coromandel (down -20.0% year-on-year), and Central Otago / Lakes District, (down -16.8% year-on-year).

“This month, the data offers bittersweet news for buyers—although prices keep trending upward, more stock is available across the country,” said Vanessa. “This means property seekers could find themselves with more time to consider their purchase, rather than making one of the most important decisions in their life in a state of FOMO (fear of missing out).”

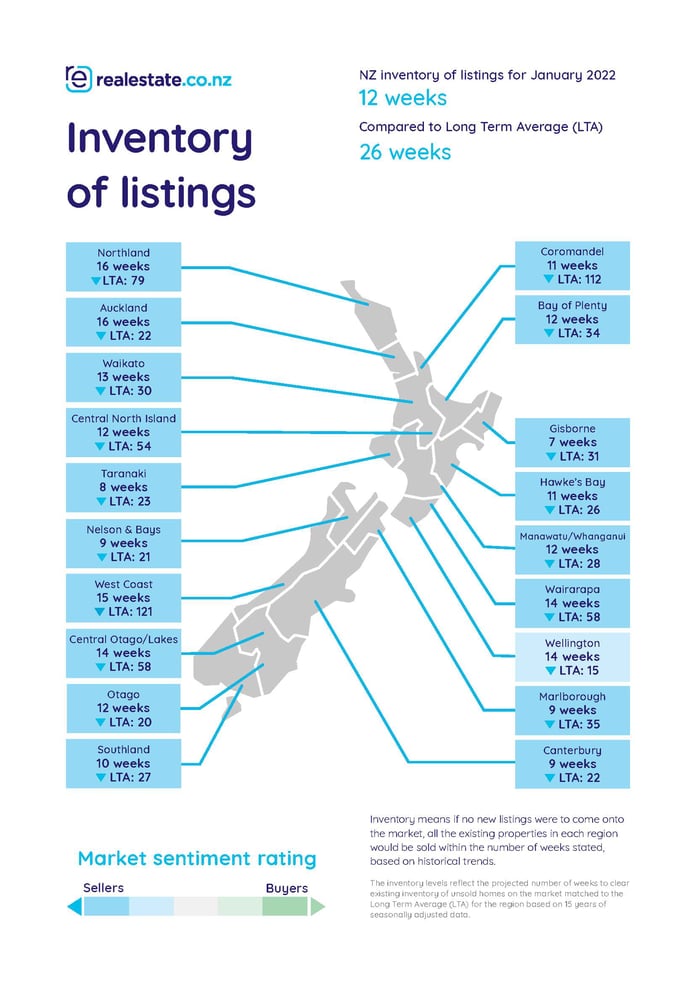

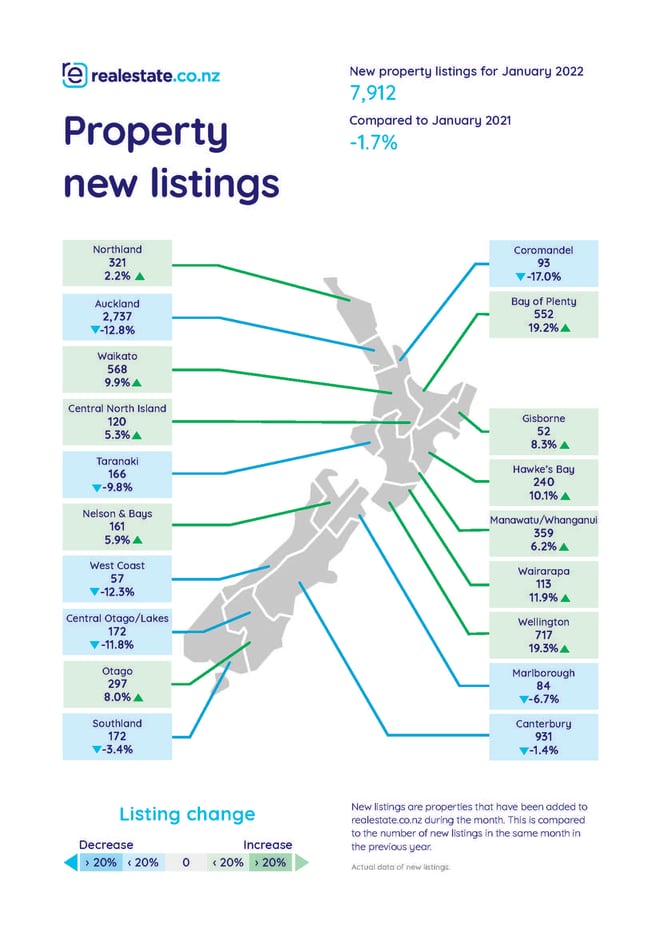

But with new listings on realestate.co.nz down slightly by -1.7% year-on-year in January, Vanessa says that the uptick in total stock isn’t due to a large influx of properties for sale.

“A significant factor at play is that the sale of dwellings is slowing—and we have tightened lending rules to thank for that,” said Vanessa.

In their December 2021 report, the Real Estate Institute of New Zealand (REINZ) stated that, following the amendments to the Credit Contract and Consumer Finance Act (CCCFA), property sales had slowed by 29.4% year-on-year nationwide, noting they’d received reports from around the regions of a falloff in buyer numbers.

“We’re starting to hear anecdotal reports of prospective buyers having to explain everyday purchases like takeaways and online subscriptions to qualify for a mortgage. It’ll be interesting to see what impact this has on the market in the coming months,” said Vanessa.

What’s left for first-home buyers?

With the national average asking price now over $1 million, first-home buyers could have their sights set on apartment dwellings—the prices for which might be still in reach for some. The national average asking price for apartments was $734,459 in January 2022—up 6.0% year-on-year.

“In the last few months, prices for apartments swung between $700,000 and $800,000 nationally and climbed as high as $808,000 in November of last year. It’s difficult to call this as affordable, as acquiring a mortgage for an apartment at this price would require a significant investment for many,” said Vanessa.

“There are still pockets of affordability around the country – we see prices ranging from $300,000 to $600,000 for apartments often, depending on the region.”

But Vanessa thinks that apartment living isn’t the only beacon of hope left for first-home buyers.

“In a market like this, I’d encourage anyone with an opportunity to purchase property to get creative. Some young buyers are choosing to team up with friends to purchase homes, some are choosing to build, and others are setting their sights on rural living,” said Vanessa.

“Finding a home to call your own is the New Zealand dream, and our team is often heartened by stories of buyers getting on the ladder using imagination and good old-fashioned Kiwi ingenuity.”

For media enquiries, please contact:

Ashley Harder | 021 712 210 | ashley@realestate.co.nz

As the longest-standing provider of real estate data in real-time, realestate.co.nz offers valuable property market information not available from other sources to make it easier for New Zealanders to buy and sell property.

Glossary of terms:

Average asking price (AAP) is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released simultaneously.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. The site reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

Stock is the total number of residential dwellings for sale on realestate.co.nz on the penultimate day of the month.

02 Feb 2022