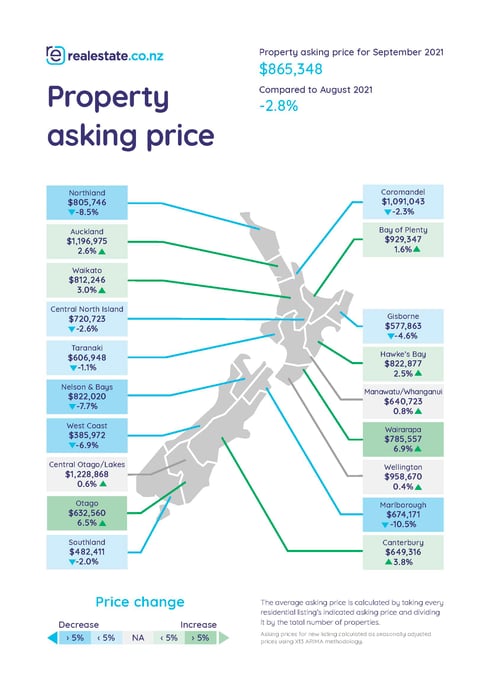

Real-time data from realestate.co.nz show that the national average asking price gently cooled month-on-month in September by -2.85%, bowing to $865,348, allowing for seasonal adjustment.

Marlborough (down -10.5%), Northland (down -8.5%) and Nelson & Bays (down -7.7%) showed the most notable month-on-month dips.

But a majority of the regions didn’t feel the cooling touch of softer prices. Auckland, despite its “times-are-tough” Delta lockdown, saw a new 14-year record high average asking price—a home in the region is now priced at $1,196,975. This was up 2.6% from August and up 22.5% when compared to September 2020.

Central Otago / Lakes District didn’t hit any records this month, but remained the most expensive region to purchase a property. A home with a remarkable view is now priced, on average at $1,228,868, up 18.1% in just a year.

Sarah Wood CEO of realestate.co.nz, says it’s difficult to tell what impact Delta has had on the market. “It would be easy to assume that a lockdown would have a major impact on asking prices. We saw a jump in average asking prices in Auckland after COVID April 2020, but that could have been due to a number of factors—expats coming home, favourable interest rates and access to lending.”

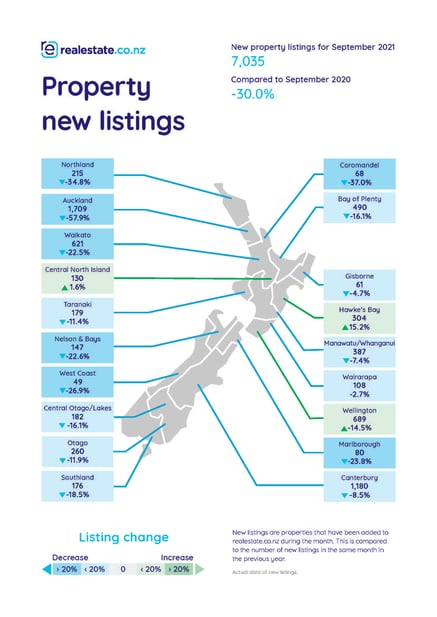

“What we can certainly expect a lockdown to affect though, is new property listings. Agents can’t hold viewings during Level 4 and the restrictions are tight in Level 3,” Sarah continued. “Total new listings were down on our site by 30.0% year-on-year—a result of the lockdown—but showed signs of momentum in September, particularly in Hawke’s Bay and Wellington.”

New listings and stock remain a challenge

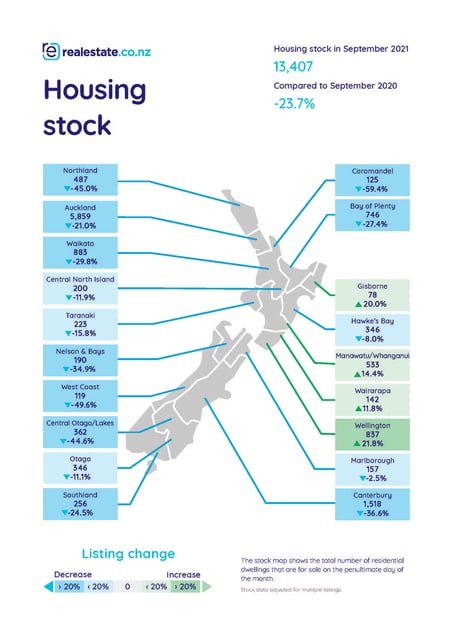

Only one region hit a record low in total stock this month—the West Coast (down -49.6% compared to last year). This is perhaps due to recent reports that it is the region that offers the best investment return in the country*. However, stock and new listings remain a challenge across New Zealand.

The Coromandel (down -59.5%), Northland (down -44.9%) and Central Otago / Lakes District (down -44.6%) all saw the most significant stock dips when compared to September last year.

Although new listings have jumped (as expected) this spring, the year-on-year data suggests the sales season has had a slower start.

Unsurprisingly, Auckland had the biggest gap—the region saw a -57.9% drop in new listings while agents and sellers were unable to hold open homes. The Coromandel (down -37.0%) and Northland (down -34.8%) were the other most notable dips in new listings, likely due to their proximity to Auckland.

Two regions bucked the low listings trend—Hawke’s Bay (up 15.2%), and Wellington (up 14.5%).

“It’s heartening to see that agents and vendors have been active in Hawke’s Bay and Wellington. It looks like those regions are about to witness a vigorous transaction season. Hopefully other regions follow suit,” said Sarah.

“And I’d caution pessimism so early into spring,” Sarah continued. “We shouldn’t compare this September to last. This time last year we were all in Level 2, which is more conducive to transacting than our current Alert Level situation. This spring might see a slower start, but a long tail.”

What’s up in Wellington?

The country’s capital was one of the nine regions that hit another 14-year record high average asking price in September. A home in the region now costs, on average, $958,670—up 26.3% since this time last year. And while all residential dwellings saw this increase, apartments were the most noteworthy. The price of the average apartment in Wellington has risen by 45.6% to $739,518 in just a year—a record high—while discussions on affordability push on in the windy city.

But Wellington was also one of the few regions that saw both total stock (up 21.9%) and new listings (up 14.5%) increase year-on-year.

“Low supply and high demand pushes prices up, which is why we’ve reported record stock shortages and record high asking prices consistently since 2019,” said Sarah. “But when you see stock and new listings start to increase, it could be a sign that supply is starting to meet demand. Although we’re probably a few years away from that, it’s heartening to see these signs in our capital, perhaps other major metropolitan areas will follow.”

Apartments and affordability: What’s next for first-home buyers?

With asking prices steadily climbing month after month and reports of many new builds selling for higher than their valuation, many first-home buyers will be looking to townhouses and apartment dwellings to climb onto the ladder.

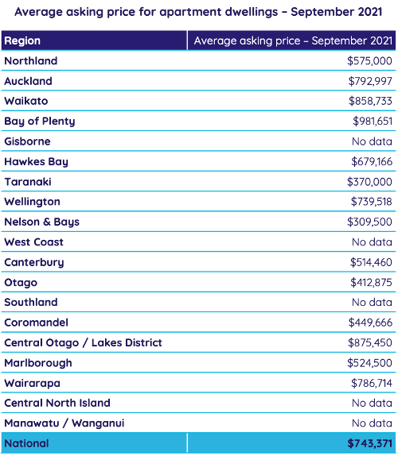

Depending on where they live, average asking prices for apartments ranged from $309,500 in Nelson & Bays to $981,651 in the Bay of Plenty in September 2021—although this data may be slightly skewed by low listing numbers.

“The lock-up and leave lifestyle is commonplace in many countries around the world. Although it’s not the quarter-acre dream, many European and Asian countries have turned apartment living into a fantastic lifestyle,” said Sarah.

“This month, the average apartment in New Zealand was priced at about $750,000 according to our data, which poses and interesting question about what it means for a home to be affordable. There are certainly many conversations to be had about futureproofing the market for our young people.”

*REINZ Property Report, June 2021

For media enquiries, please contact:

Ashley Harder | 021 712 210 | ashley@realestate.co.nz

As the longest-standing provider of real estate data in real-time, realestate.co.nz offers valuable property market information not available from other sources to make it easier for New Zealanders to buy and sell property.

Glossary of terms:

Average asking price is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released at the same time.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. As the site reflects 97% of all properties listed through licensed real estate agents in New Zealand, this gives a representative view of the New Zealand property market.

Seasonal adjustment is a method realestate.co.nz uses to better represent the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated, to prevent exceptional listings from providing false impressions.

Stock is the total number of residential dwellings that are for sale on realestate.co.nz on the penultimate day of the month.

04 Oct 2021