The impact of the pandemic has been far-reaching, and New Zealand’s housing market has not been spared. But the latest real-time data from realestate.co.nz suggests that the market might be returning to pre-COVID-19 levels.

Vanessa Williams, spokesperson for realestate.co.nz, says that new listing and stock numbers are starting to mirror those seen in 2018 and 2019 – before the pandemic was on the radar.

“With February 2022 new listings reflecting February 2018 levels and stock increasing almost 50% year-on-year, we might be seeing some changes to the property market in 2022,” says Vanessa.

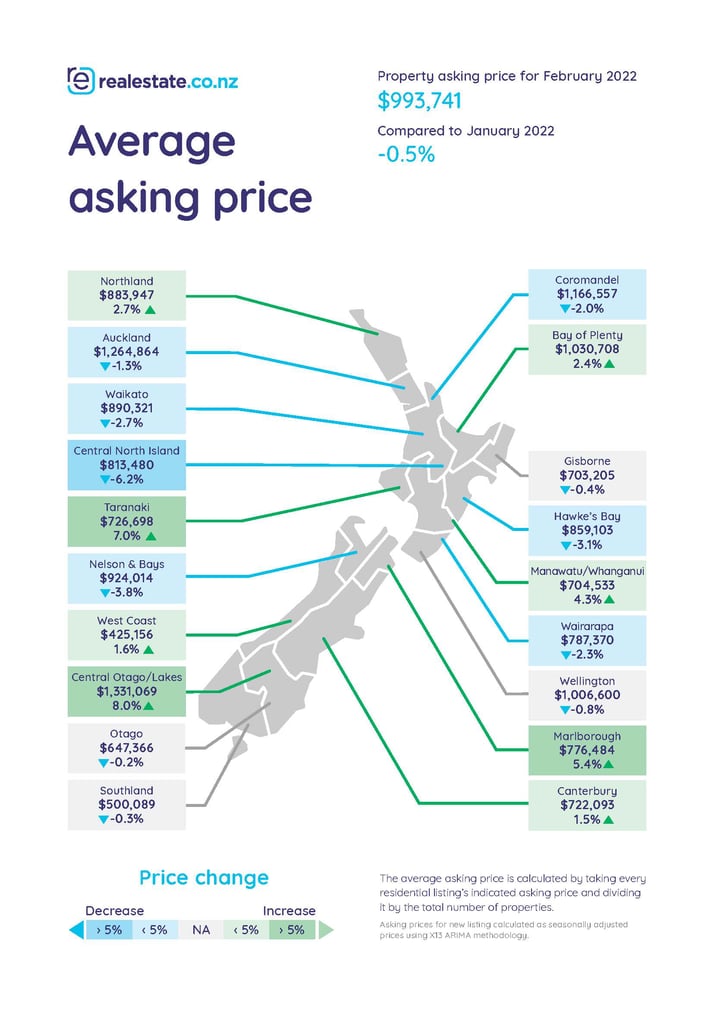

Compared to January 2022, average asking prices also slightly dipped nationally and in 11 of our 19 regions in February. Vanessa says that while the prices have only gone backwards by relatively small percentages, this could hint at the market cooling.

“It’s too early to say categorically that this is the beginning of a major shift, but this might give hope to those trying to get onto the property ladder,” says Vanessa.

Asking prices drop back from January 2022

Year-on-year, average asking prices increased by 23.1% nationally last month. Five of nineteen regions also hit 15-year record highs, with the average asking price now $883,947 in Northland, $1,030,708 in Bay of Plenty, $726,698 in Taranaki, $722,093 in Canterbury, and $704,533 in Manawatu/Whanganui.

But there are hints that the market might be cooling.

“Average asking prices went backwards nationally and in 11 of 19 regions in February compared to the previous month. While it is too early to call this a trend, if vendors are asking less for their properties in February than they did in January, it could suggest a market slowdown is on the way,” says Vanessa.

Compared to January, February’s average asking prices decreased by -1.3% in Auckland, -2.7% in Waikato, -3.1% in Hawke’s Bay, -3.8% in Nelson & Bays, -2.0% in Coromandel, -2.3% in Wairarapa, and -6.2% in Central North Island.

In Gisborne, Wellington, Otago, and Southland, the average asking price dips were less than -1% month on month, as was the change to the national average asking price.

“We need to keep in mind that we are still seeing double-digit year-on-year growth in all regions, but I would be following this data closely over the next few months if I were looking to buy. It might just spell good news to come,” says Vanessa.

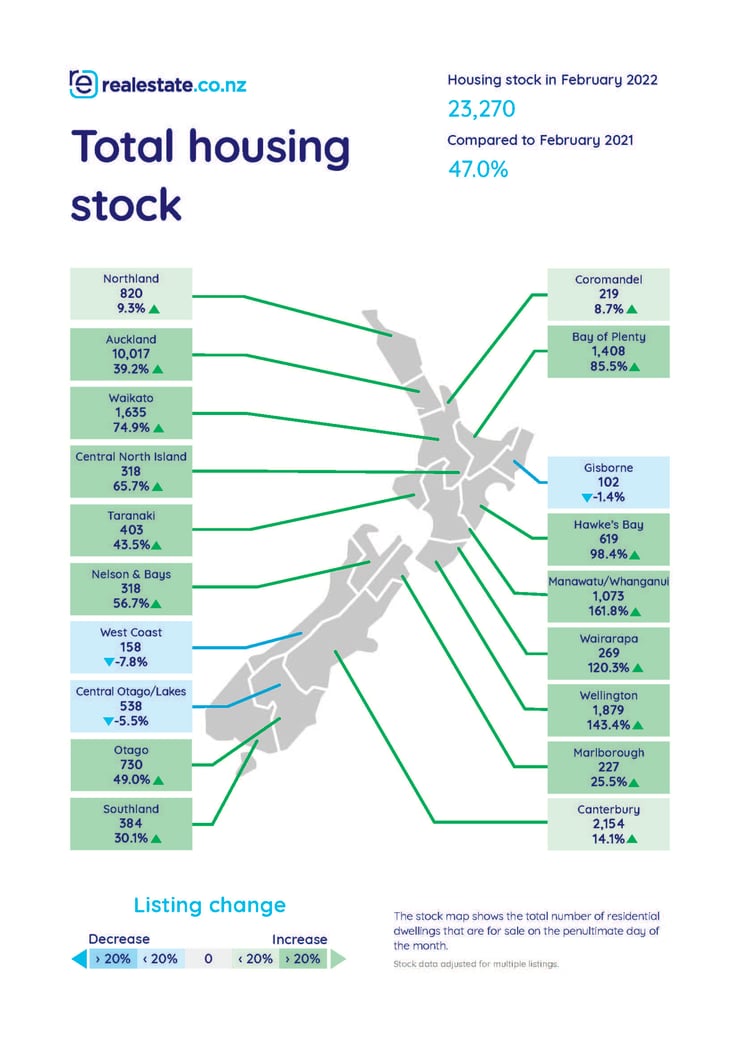

Total homes available for sale above 23,000 for the first time since June 2019

New Zealand’s long term stock shortage is well documented, but the good news for buyers is that national stock levels are trending up. Last month, we saw a 47.0% year-on-year increase in the total homes available for sale. 23,270 homes were available on realestate.co.nz at the end of February 2022; the last time we saw stock above 23,000 was June 2019

February’s numbers are a stark increase on the country’s recent 15-year record low of 12,249 in August.

“Since August 2021’s all-time low, we have seen stock levels increase steadily. Although we are still a long way off 2008 stock highs of nearly 60,000 homes, the almost 50% year-on-year increase will be encouraging for those looking to buy as it means more choice and possibly less competition,” says Vanessa.

Since COVID-19 was first declared a national emergency in March 2020, stock levels around the country have been low.

“There were just 15,829 total homes available for sale around the country in February last year – that means Kiwis had 7,441 fewer homes to choose from a year ago which is significant when you consider our population is now over 5 million.”

“The increasing numbers suggest that we might be moving back towards pre-COVID-19 levels, and this will be welcome news for property seekers,” says Vanessa.

Buyers in the Wellington, Wairarapa and Manawatu/Whanganui regions may have even greater cause to celebrate. Total stock levels have more than doubled year-on-year in these regions.

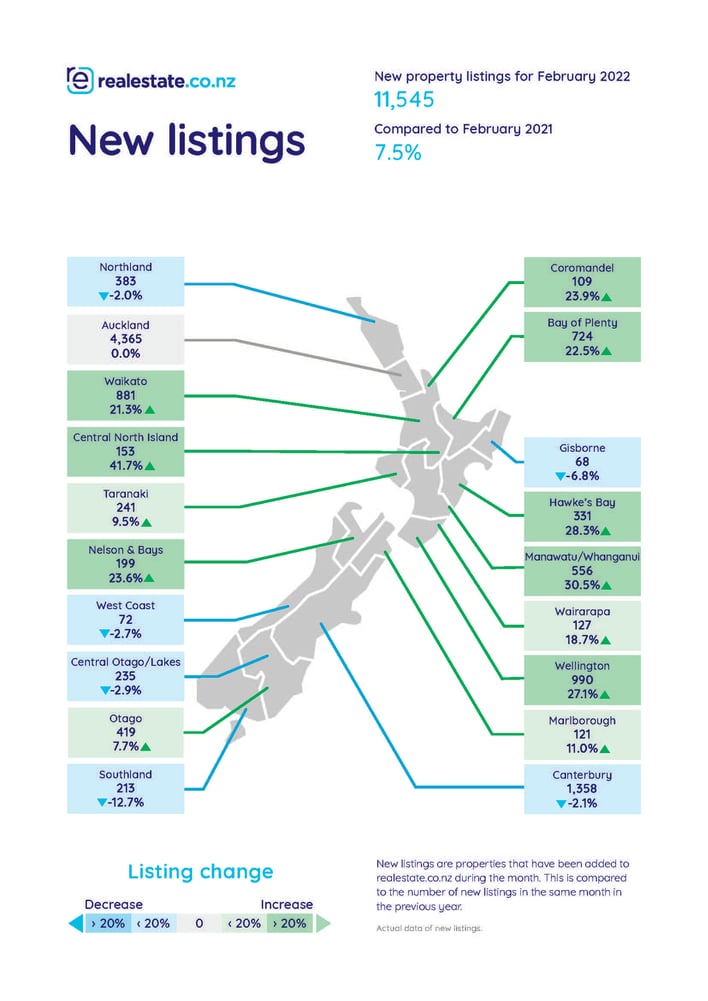

New listing numbers up and at close to pre-COVID-19 levels

Vendors have been busy this summer getting their homes ready for sale. Real-time data from realestate.co.nz shows that new listings are up year-on-year by 7.5% nationally, with 11,545 new homes coming onto the market last month.

Vanessa says the numbers are slightly above the 11,269 new listings we saw in February 2018.

“New listing levels are typically seasonal, but we haven’t seen new listing numbers this high during February since 2018.”

Regionally, the biggest increases to new listing levels were in Central North Island (up 41.7%), Manawatu/Whanganui (up 30.5%), Hawke’s Bay (up 28.3%) and Wellington (up 27.1%).

Auckland, however, saw new listings remain flat with a 0.0% year-on-year change. Vanessa says this is particularly interesting given that Auckland went in and out of lockdowns last February, and lockdown restrictions typically reduce the number of listings coming onto the market.

“As the largest city in New Zealand, we generally see property trends driven by Auckland. But with 13 of our 19 regions seeing an increase to new listings last month, it seems regional New Zealand led the way in February,” says Vanessa.

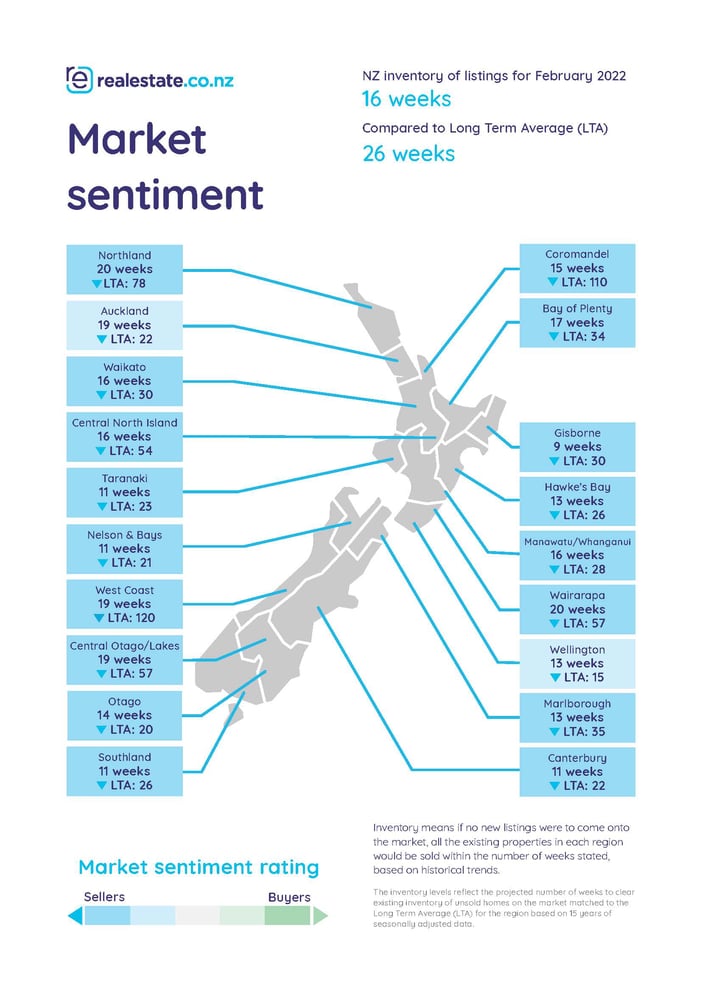

With many New Zealanders hoping for a return to normality post-COVID-19, February’s data may indicate that at least the property market is making its way back there. An increase in supply is often good news for buyers as it tends to reduce demand, which can level out prices. However, with more than a million visitors to realestate.co.nz every month and user numbers growing every year, the Kiwi love affair with property is alive and well.

ENDS

For media enquiries, please contact:

Ashley Harder | 021 712 210 | ashley@realestate.co.nz

01 Mar 2022