Interest in the Auckland property market has dropped on the back of ever increasing house prices and falling returns for investors.

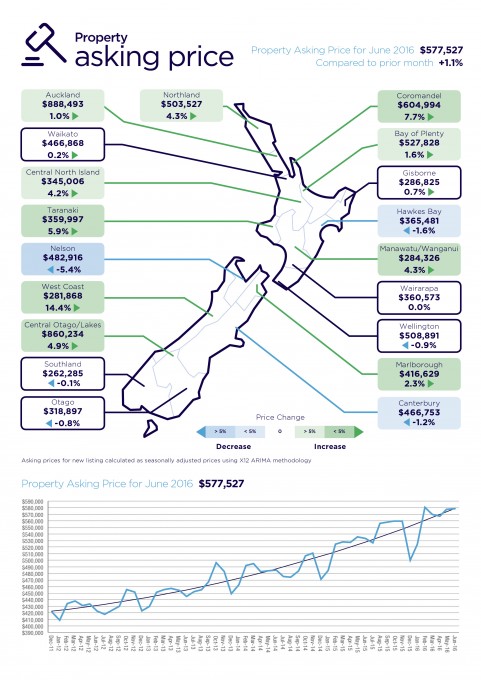

Auckland average asking prices rose again to another all-time high in June to $888,493, but searches on realestate.co.nz for properties in the city has fallen, says CEO Brendon Skipper.

“It could be a turning point for Auckland, with prices now at an all-time high they’re almost out of reach for the average income earner, with first home buyers the hardest hit,” he says.

During June, the number of users searching Auckland houses ‘for sale’ on realestate.co.nz fell by 19.33 per cent compared to the same time last year. The site also measures engagement and in June it fell by more than a third across the Auckland region when compared to June 2015.

“Nationally, the volume of traffic to our site is comparable across the country for this time of year, but it appears buyers are moving away from looking in the Auckland area in favour of other regions,” comments Brendon.

Northland, Hamilton, Tauranga and Queenstown flavours of the month

Searches for properties in Northland, Hamilton, Tauranga and Queenstown were up significantly in June compared to the same period last year.

“It appears Aucklanders still want to stay in relatively close proximity to our biggest city, but in terms of affordability they are forced to move even further afield, or they are making lifestyle changes,” he observes.

Hot spots in Northland are Waipu, Whangarei Heads, Paihia and Tutukaka which all have a significant increase in users looking in those areas.

“Whangarei Heads is the suburb to watch, with online engagement up by 42 per cent on same time last year,” notes Brendon.

In the Far North, Kerikeri Surrounds, Paihia and the Karikari Peninsula were the most searched.

Further south, Hamilton and Tauranga continues to attract high levels of online engagement and Queenstown continues to be a perennial favourite,” says Brendon.

Theoretical yield for new Auckland property investors takes a dive

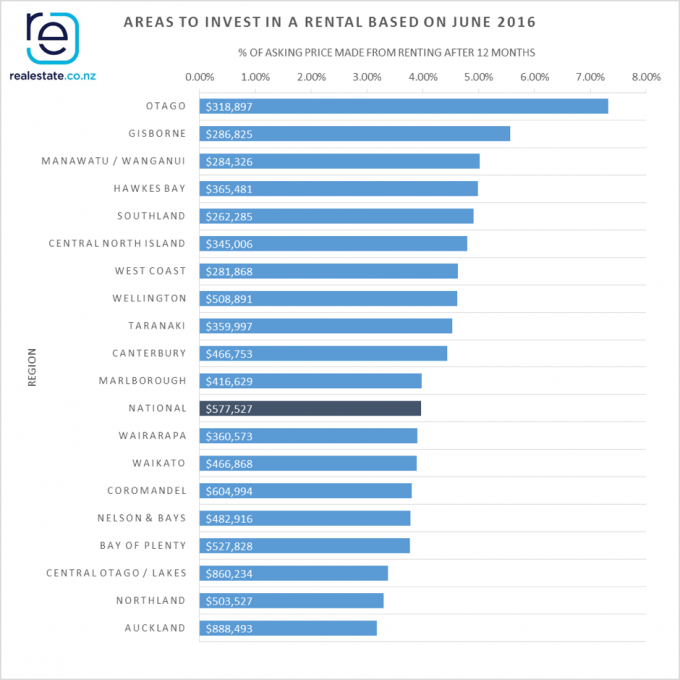

Auckland property investors are taking a hit on their theoretical yield in the rental market.

“Investors buying a house in June at the average price of $888,493 theoretically would receive 3.18 per cent yield on the average rent in Auckland – based on our calculation of average asking price vs weekly rental price, excluding all external costs,’ explains Brendon.

“This puts them at the bottom of the ladder across all 19 regions.” See chart below.

“It suggests that Auckland investors are relying on future capital gains rather than rental returns or having to look at other property types when considering their investments”

Nationally, the average theoretical yield on a property is 3.96 per cent (based on the average price and rented out at the average asking rental price).

By comparison, the star performer in terms of theoretical yield on investment property is Otago, showing an average yield of 7.32 per cent.

National picture shows that sellers are back in the market

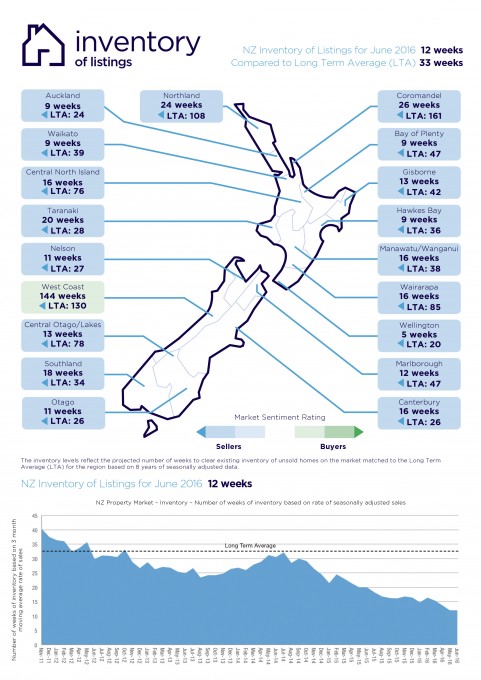

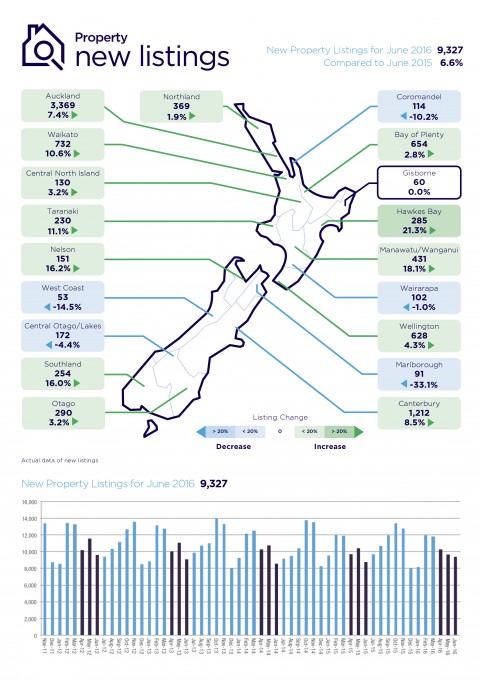

Across the nation, sellers are coming back in the market with 15 out of the 19 regions showing an increase in new listings compared to the same time last year.

“This is significant, as June is traditionally a quiet time of the year, on a par with December and January” explains Brendon.

“The message seems to be getting through that with the shortage of listings and the speed in which properties are selling. It’s a sellers’ market.

“While there is still a shortage of listings this is a positive sign for getting more equilibrium in the marketplace,” he says.

01 Jul 2016