A pre-election snapshot of the New Zealand property market reveals a softer-than-expected “spring swing” has begun. September saw new listings down year-on-year in most regions as Kiwis face increasing interest rates and the looming election.

The latest data from realestate.co.nz also showed the national average asking price stayed flat during September. As New Zealanders await Election Day on 14 October, it appears that the property market is also waiting for the result.

Vanessa Williams, spokesperson for realestate.co.nz, says it is typical for Kiwis to hold off on making significant financial decisions in the face of uncertainty:

“We see it all the time that Kiwis hold off on making big decisions ahead of an election while they wait to see who comes into government and how expected policies might impact them.”

- Would opening the $2 million dollar market hinder Kiwi property dreams?

- Soft start to spring with new listings down in most regions year-on-year.

- National average asking price stays flat, paving a runway to the election

- Average asking price in all regions above half a million for the first time as West Coast enters the $500,000s

Would opening the $2 million market hinder Kiwi property dreams?

‘Election promises’ that would make it easier for overseas investors to purchase property over $2 million has left some Kiwis asking what that could mean for their homegrown property dreams.

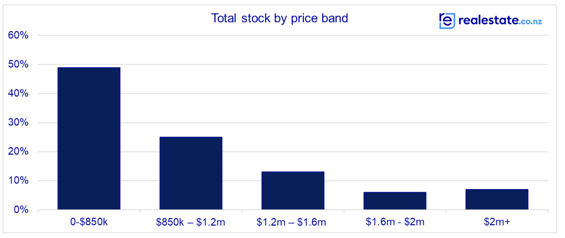

There are currently more than 23,500 homes for sale on realestate.co.nz, with only around 7.0% priced at $2 million or above. Vanessa suspects that given how niche this part of the market is, it’s likely the majority of property seekers will be unaffected by this change if it goes ahead:

“We are talking about the higher end of the market, where there is less demand. Homes priced over $2 million tend to spend more than twice as long on our site than those priced closer to the national average asking price, telling me that demand is not currently satisfying supply in this area of the market.”

She adds that even before the Overseas Investment Amendment Act came into force in 2018, which prevented most overseas investors from buying in New Zealand, only around 3.0% of property sales were to non-NZ citizens or resident visa holders.

"For argument's sake, even if we get back up to those peak levels, 3.0% of an already small subset of the market isn’t likely to significantly impact most Kiwis.”

She says we need to focus on the first home market, ensuring Kiwis have more affordable living options at the beginning of the ladder.

Soft start to spring with new listings down in most regions year-on-year

Nine of our 19 regions saw the lowest new listing numbers for any September on record last month.

Waikato, Gisborne, Hawke’s Bay, Wellington, Otago, Southland, Central Otago/Lakes District, Wairarapa, and Manawatu/Whanganui all fell short of typical September numbers.

Vanessa suspects that the combination of high interest rates and the election is behind lower-than-expected new listings:

“The property market has a seasonal nature, cycling in sync with the warmer and cooler months of the year.”

“What’s interesting this year is we are seeing a softer start to spring than expected. The election, suspected post-election Reserve Bank movements, and interest rate rises appear to be dampening the influx of listings that warmer weather usually brings to market.”

Despite new listings being down last month in most regions, year-on-year growth was seen in Marlborough (up 3.3%), Auckland (up 6.6%), Central North Island (up 9.6%), and Nelson & Bays (up 14.0%).

National average asking price stays flat, paving a runway to the election

The national average asking price stayed flat last month at $871,400, down just 0.1% month-on-month. In the main centres, Auckland (up 0.4%), Wellington (down 0.4%) and Canterbury (down 1.6%) also saw average asking prices remain relatively flat compared to last month.

Vanessa says this could be a side effect of the election. A pause as Kiwis wait to enter the polling booths. However, compared to September last year, average asking prices were down 5.3% nationally and by varying degrees in most regions.

Bucking the trend was the West Coast, which saw average asking prices increase by 21.2% year-on-year. Central Otago/Lakes also saw its average asking price increase by 2.3% year-on-year.

Average asking price in all regions above half a million for the first time as West Coast enters the $500,000s

A new record has been set for the West Coast, which hit an all-time high average asking price during September. Reaching over half a million dollars for the first time since records began in 2007, the average asking price in the region last month was $515,183.

Vanessa says that while the West Coast was the last region to tip over $500,000, finding property in New Zealand for under half a million is still possible:

“I believe in every market, there are opportunities for everyone to find the perfect property. A quick search on our site shows over 3,200 houses listed for $500,0000 or less right across the motu. Buyers looking for more cost-effective housing may need to look a little beyond their backyard to find them.”

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

Want more property insights?

- Market Insights: Search by suburb to see median sale prices, popular property types and trends over time.

- Sold properties: Switch your search to sold to see the last 12 months of sales and prices.

- Valuations: Get a gauge on property prices by browsing sold residential properties, with latest sale prices and an estimated value in the current market.

Find a glossary of terms here.

02 Oct 2023