Real-time data from realestate.co.nz shows that low stock is continuing to drive increased prices across the country, with seven regions reaching all-time asking price highs in November.

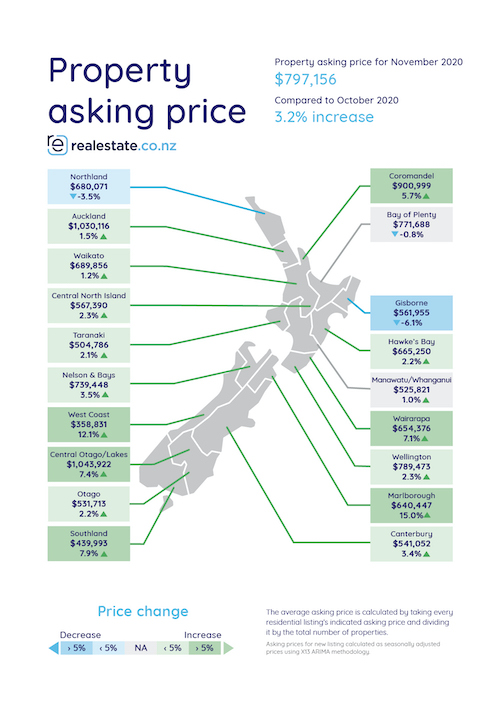

The national average asking price is $797,156 – a 17.1% increase on November last year.

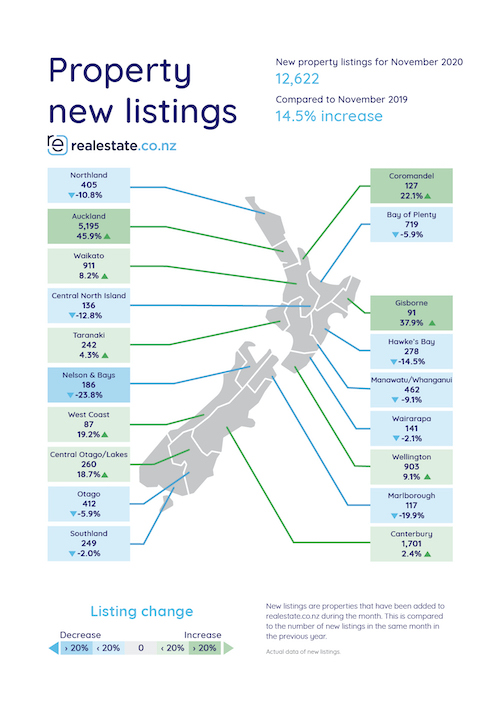

Vanessa Taylor, spokesperson for realestate.co.nz, says although 12,622 new listings came onto the market last month, overall stock levels remain low around New Zealand.

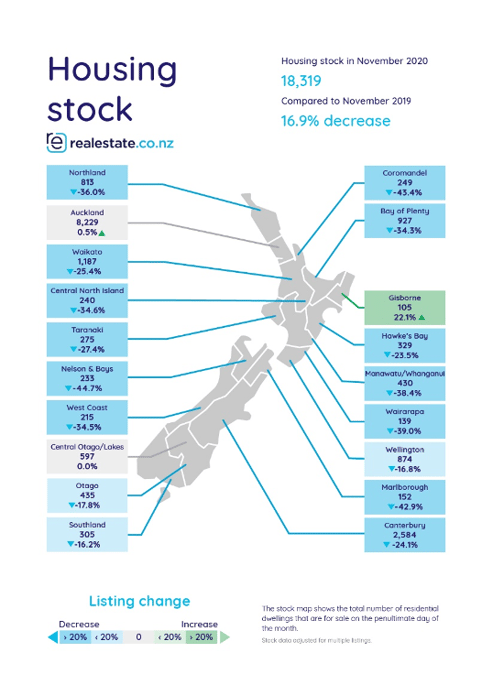

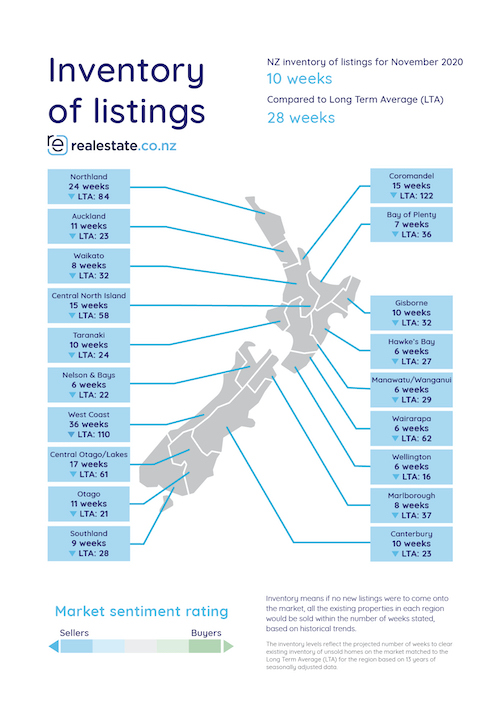

“Nationally the total number of homes available for sale in November was down 16.9% on November 2019, with nine regions recording 13-year record stock lows. That’s despite a 14.5% year-on-year increase in new listings,” says Vanessa.

Although buyers will welcome the news that many regions saw an increase in properties coming onto the market last month, it may not be time to celebrate just yet.

Vanessa says demand remains strong with more than 1.33 million users recorded on realestate.co.nz in November 2020 - significantly more than the 1.08 million users searching during the same period in 2019.

“We know that Kiwis are still out looking for property and as long as demand keeps outweighing supply, we’ll likely continue to see prices pushed upwards.”

-2.png?width=613&height=445&name=Property%20Asking%20Price%20-%20Seasonally%20Adjusted%20(Nov%202020)-2.png)

Average asking prices continue to climb with 13-year record highs in seven regions

Seven regions have hit all-time average asking price highs in November, according to the latest data from realestate.co.nz.

Auckland, Waikato, Hawke’s Bay, Southland, Coromandel, Wairarapa and Manawatu/Whanganui all reached peak asking prices since realestate.co.nz records began 13-years ago.

Nationally, the average asking price for Kiwi properties is $797,156 – up 3.2% on last month and up a significant 17.1% on November 2019.

Vanessa says asking prices were up year-on-year in every region across the country, which is good news for those in the market to sell.

“While average asking prices indicate what vendors are expecting to get rather than what properties are actually selling for, they are usually a good indicator of what will happen with sales prices,” she says.

Auckland had one of the highest average asking prices last month, topping $1 million for the third consecutive month despite a significant 45.9% year-on-year increase in new listings.

In the Waikato, average asking prices reached an all-time high of $689,856. Lifestyle properties were a key driver in the market with a record $1,324,962 average asking price - up 27.8% on November 2019.

“We saw close to 25,000 Aucklanders searching for property in the Waikato region on realestate.co.nz last month, and I expect that trend will continue as transport links continue to improve,” says Vanessa.

Lifestyle properties also reached 13-year highs in Manawatu/Whanganui where the average lifestyle asking price hit $814,344.

-2.png?width=728&height=269&name=13-year%20Record%20Average%20Asking%20Priec%20Highs%20(Nov%202020)-2.png)

New listings up – but housing shortage remains with nine regions at record stock lows

Despite 12,622 new listings coming onto the market nationally last month, a 14.5% year-on-year increase, the long-term stock shortage continues to prove challenging for Kiwi buyers.

Nine regions fell to 13-year total stock lows in November, with only 18,319 homes available for sale across New Zealand.

“Demand is still outstripping supply with the total number of homes on the market in November down 16.9% on the same month in 2019,” says Vanessa.

All-time stock lows were recorded in Northland, Waikato, Bay of Plenty, Hawke’s Bay, Nelson & Bays, West Coast, Coromandel, Marlborough, and Manawatu/Whanganui.

Nelson & Bays, Coromandel, and Marlborough had the lowest stock compared to 2019, decreasing by 44.7%, 43.4% and 42.9% respectively.

Gisborne bucked the trend with a 22.1% stock increase, while Auckland and Central Otago/Lakes maintained similar year-on-year stock levels to 2019.

“We can expect stock to remain low in December, when we typically see a drop off in new listings as the busy holiday season approaches,” says Vanessa.

“It will be interesting to see how things trend in the new year and I’m sure buyers will be hoping new listings continue to increase.”

Strong Gisborne market records 31.1% year-on-year price increase

While it was one of the few regions that didn’t record a month-on-month average asking price increase in November, the Gisborne market is still looking strong as 2020 draws to a close.

It now costs on average $561,955 to buy a home in the region – over $130,000 more than it did in November 2019.

Vanessa says the 31.1% increase puts Gisborne ahead of every other region in the country for year-on-year average asking price increases at the end of November.

There is some good news for buyers though, with 91 new listings coming onto the market last month, up 19.7% on October and 37.9% on the previous year.

“That’s quite a remarkable number when you consider there were only 105 properties for sale in total across the Gisborne region in November,” says Vanessa.

More than 8,600 users searched for property in Gisborne on realestate.co.nz in November.

“Unsurprisingly with the region’s sought-after coastline, we saw ‘beach’ ranked as the top keyword search term across the Gisborne region,” says Vanessa.

The most searched locations were Tolaga Bay and Wainui, with Gisborne City Surrounds rounding out the top three.

For media enquiries, please contact:

Trish Fitzsimons | 021 022 96927 | trish@realestate.co.nz

About realestate.co.nz

Established before Google, in 1996, realestate.co.nz is New Zealand’s longest-standing property site. With residential, lifestyle, rural and commercial property listings available, realestate.co.nz is the place where serious buyers look for property. Dedicated to property, realestate.co.nz has no private sales and has search functionality that’s second to none to get you to your perfect property faster.

Glossary of terms:

As the only provider of real estate data in real-time, realestate.co.nz offers valuable property market information not available from other sources.

- Average asking price is not a valuation. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released at the same time.

- Inventory is a measure of how long it would take, theoretically, to sell the current stock at current average rates of sale if no new properties were to be listed for sale. It provides a measure of the rate of turnover in the market.

- New listings are a record of all the new listings on realestate.co.nz for the relevant calendar month. As realestate.co.nz reflects 97% of all properties listed through registered estate agents in New Zealand, this gives a representative view of the New Zealand property market.

- Demand: the increase or decrease in the number of views per listing in that region, taken over a rolling three-month time frame, compared to the same three-month time frame the previous year – including the current month.

- Seasonal adjustment is a method realestate.co.nz uses to better represent the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

- Truncated mean is the method realestate.co.nz uses to provide statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated, to prevent exceptional listings from providing false impressions.

30 Nov 2020