↑ Property stock and Christmas stockings both up in December

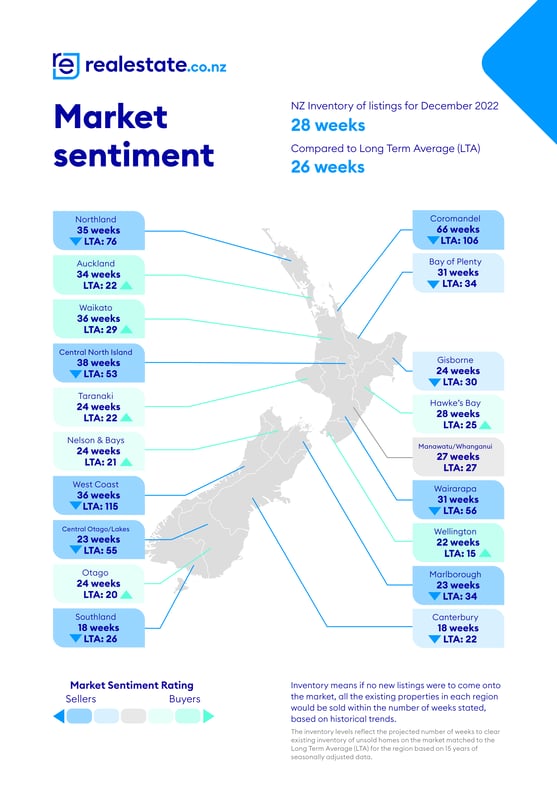

Latest data from realestate.co.nz shows that it wasn't seven swans a-swimming but seven buyers' markets that closed out 2022. Following an interesting year when the national average asking price trended downwards in response to rising inflation, interest rate hikes and shifting lending rules, 2022 has been a period of change for the property market.

"There have been a lot of external factors at play this year. Not only have we seen significant economic activity within New Zealand and globally, but we have also been in recovery from the skyrocketing prices we saw during the peak of pandemic restrictions," says Vanessa Williams, spokesperson for realestate.co.nz.

Following the upward trend of the last few months, stock levels increased significantly in December 2022. This starkly contrasts with the all-time stock lows we saw throughout 2021.

Vanessa explains that it is typical to see changes like this every so often in a cyclical market:

"It will be interesting to see what the new year brings. People tend to hold off buying and selling around elections, so we will have to wait and see if this rings true for 2023."

Buyers' markets nationally and in seven regions

Buyers' markets emerged nationally and in Hawke's Bay, Taranaki, and Otago last month, while Auckland, Waikato, and Nelson & Bays continued consecutive buyers' market streaks. Following a brief hiatus, Wellington also returned to a buyers' market in December after favouring property seekers for eight successive months between March and October 2022.

In addition, Manawatu/Whanganui teetered on the edge of a buyers' market at the end of 2022.

Vanessa suggests that increasing interest rates have contributed to the creation of buyers' markets.

"In December 2021, the average two-year fixed mortgage rate was 4.73%. In November 2022, this was up to 6.75%. Money is more expensive than it was 12 months ago, which means there is less credit available to buyers."

"Fewer buyers in the market combined with stock increases around the motu create a perfect storm where supply exceeds demand, and buyers' markets emerge," says Vanessa.

She adds, however, that buyers' markets don't necessarily spell doom and gloom for sellers:

"A buyers' market gives buyers and sellers more time to negotiate and do their due diligence. It doesn't automatically mean low prices."

Stock up in all regions

All regions saw year-on-year total stock increases during December 2022, and four regions saw stock more than double. Growing by more than 100% was Coromandel (up 175.3%), Nelson and Bays (up 147.2%), Taranaki (up 118.6%) and Central North Island (up 110.3%). National stock levels were also up by 55.3% year-on-year.

Vanessa says those browsing for property at summer holiday hotspots have more to choose from than they did a year ago:

"This is especially significant in small regions like the Coromandel. At the end of December 2021, there were just 157 homes for sale in the region. The end of December 2022 had 432 homes on the market."

"It's great for buyers as it increases their chances of finding a property that suits their lifestyle."

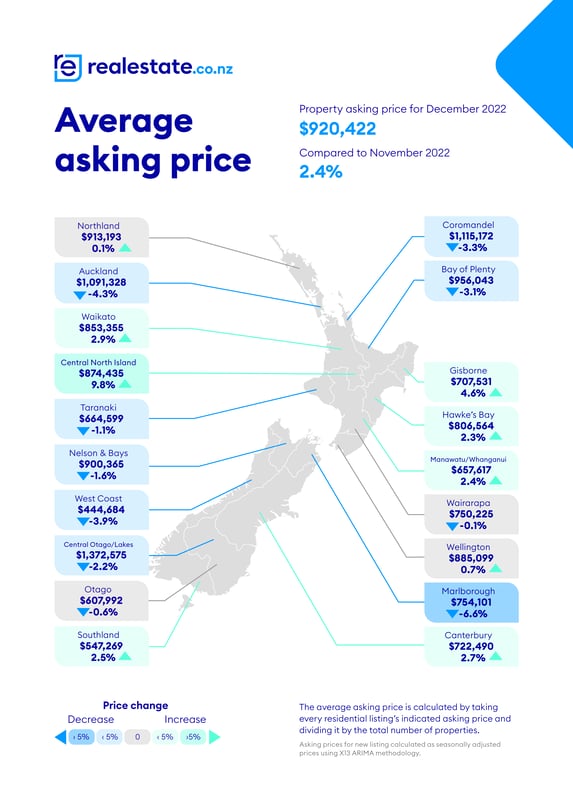

Record average asking price for Southland

Santa's elves may have swapped the South Pole for Southland last month, with the region's average asking price hitting $547,269 for the first time since records began 15 years ago. Up 10.6% compared to December 2021, and bucking the national trend, Southland has seen prices trend upwards throughout 2022.

The record price high may result from demand exceeding supply; new listings in the region were down by 39.3% compared to the same month last year.

"As in most regions, population growth has slowed in Southland during the last 12 months, so we can't point to migration as a factor in the price growth."

"However, with an average asking price of $547,269, just over half of the national average asking price, perhaps Kiwis have recognised the region as a great place to own property," says Vanessa.

Nationally, the average asking price increased to $920,422 in December after dipping just below $900,000 in November 2022.

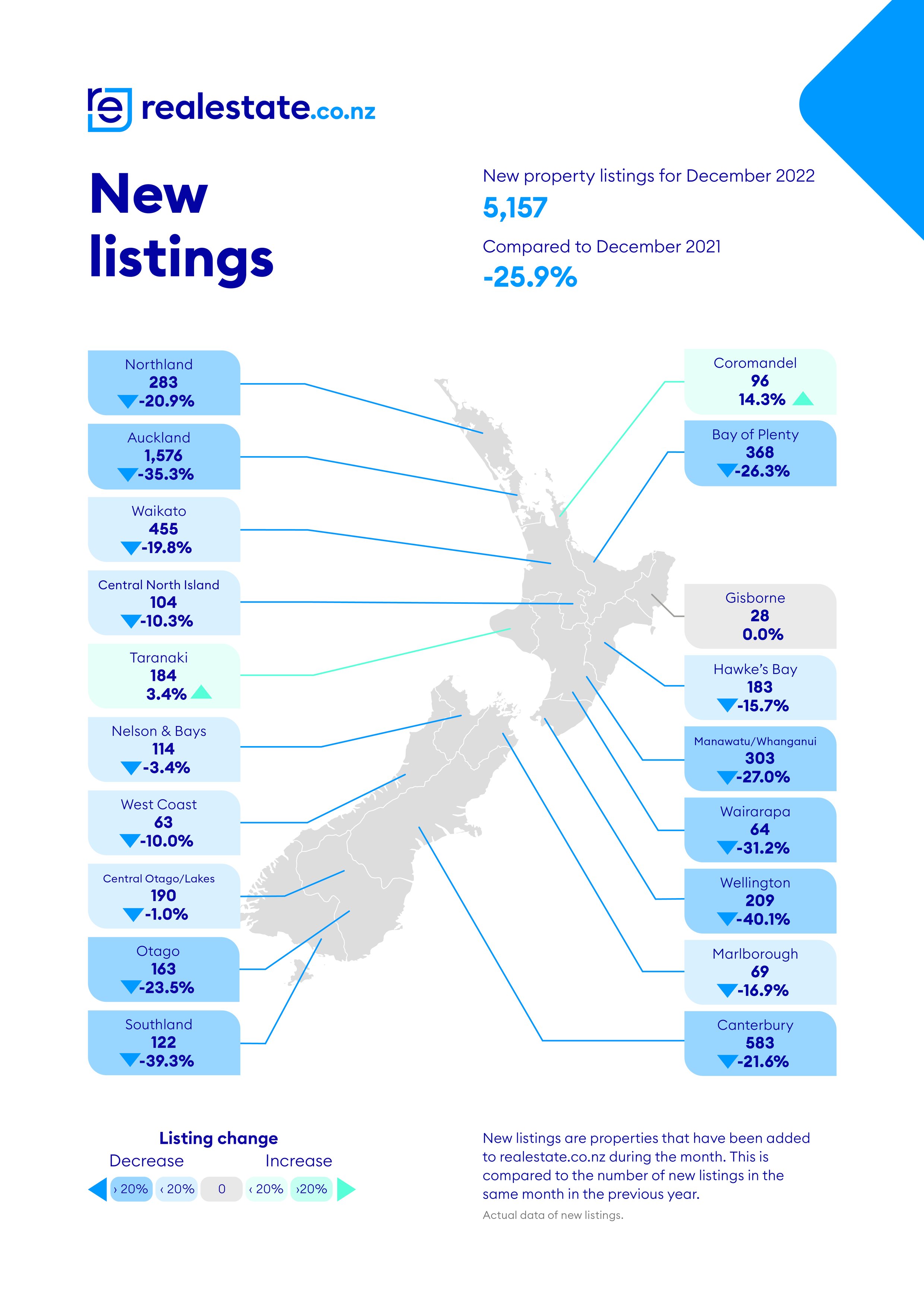

New listings down in almost all regions

New listings down in almost all regions

New listings remained low in almost all regions last month compared to December 2021. Year-on-year only Taranaki and Coromandel saw a rise in new listings, while Gisborne remained static.

"In December 2022, new listings dropped by more than -20% nationally and in nine regions. In other words, fewer people put their homes on the market in December 2022 than in December 2021."

"There could be many reasons for this; the coming election, nervousness around prices or the fact that finance is more expensive than it was a year ago," says Vanessa.

She also notes that while Auckland and parts of Northland and Waikato had just come out of lockdown restrictions in December 2021, this doesn't appear to have skewed the drop to new listings in December 2022.

"Generally, we saw an influx of new listings following lockdown periods, but this was not the case nationally in December 2021. Instead, new listings were at a similar level as the previous December (2020)," says Vanessa.

Irrespective of the numbers, data from realestate.co.nz shows Kiwis are still interested in property. In December 2022, over 960,000 users visited the site while still managing to get in their Christmas shopping.

![realestate.co.nz Total Housing Stock December 2022[45]](https://news.realestate.co.nz/hs-fs/hubfs/realestate.co.nz%20Total%20Housing%20Stock%20December%202022%5B45%5D.png?width=573&height=810&name=realestate.co.nz%20Total%20Housing%20Stock%20December%202022%5B45%5D.png)

For media enquiries, please contact:

Angela March | angela@brainchild.co.nz | Brainchild

About realestate.co.nz

As New Zealand’s longest-standing property website, realestate.co.nz’s mission is to empower New Zealanders with a property search tool they can use to find the life they want to live. With residential, lifestyle, rural and commercial property listings, realestate.co.nz is the place to start for those looking to buy or sell property.

Whatever life you’re searching for, it all starts here.

Glossary of terms:

Average asking price (AAP) is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released simultaneously.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. The site reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

10 Jan 2023