Lowest new listings autumn on record

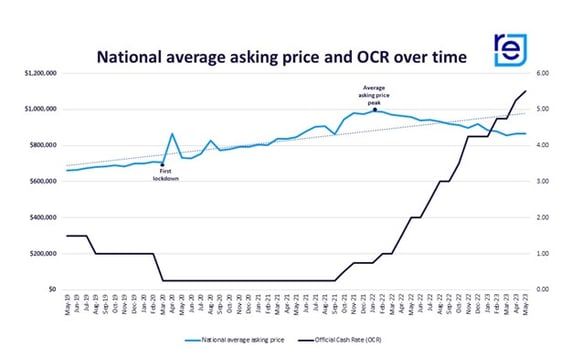

New data from realestate.co.nz suggests that average asking prices may have hit the low point following a turbulent few years. After peaking in January 2022, average asking prices have steadily decreased. But after a slight lift in March, asking prices have remained flat for the last two months.

Vanessa Williams, spokesperson for realestate.co.nz, says the pandemic, inflation, rising interest rates and recession fears have all impacted the New Zealand property market:

"Many expected a property market crash in response to COVID-19, but instead, average asking prices trended up consistently until the beginning of 2022 when other economic factors stepped into the driver's seat."

"I suspect we may have reached a so-called 'bottom' of this trend or, at the very least, a turning point. But we will have to watch what happens in the coming months to know for sure."

Interestingly, this flattening might coincide with peaking interest rates following last week's 11th consecutive OCR hike. Nathan Miglani, Managing Director and Head of Lending for NZ Mortgages, suggests that if we're not already at the peak of interest rates, then we're very close to it:

"We anticipate rates beginning a gradual descent from late 2023, so our general advice is to fix for a short term where possible, say one year or 18 months. With interest rates likely to fall, fixing for a long term could mean a hefty breakage cost if circumstances change and you need to restructure early."

The relationship between average asking prices and the OCR provides valuable insights. Vanessa suggests, for example, that high interest rates are one of the factors impacting the slow pace we've seen in the market recently.

"When the cash rate is high, finance becomes tighter, meaning some buyers have to reconsider their lending options. However, when the cash rate is low, finance is more readily available, and buyer confidence tends to create a bit of activity in the market."

Nathan adds that they are already seeing this momentum starting to increase in the market:

"Some buyers believe that rates have already peaked, and they're making decisions based on the idea that rates will be going down."

We might be at the bottom, but average asking prices are still up 22.5% on pre-COVID-19 levels

Despite the doomsday property market stories many Kiwis are hearing, average asking prices are still above what they were pre-COVID-19, and this should be viewed as good news for property owners concerned about shrinking equity.

"Going into our first lockdown in March 2020, the national average asking price was $707,233. Last month, it was $866,696 – a solid $159,463 or 22.5% increase in just over three years," says Vanessa.

Year-on-year, average asking prices were down in almost all regions compared to May 2022, but Vanessa urges property owners not to get discouraged by short-term dips.

"Typically, property isn't a short-term investment. Looking back over the last 16 years of our data, no matter what's happened economically, average asking prices have always increased in the long term," explains Vanessa.

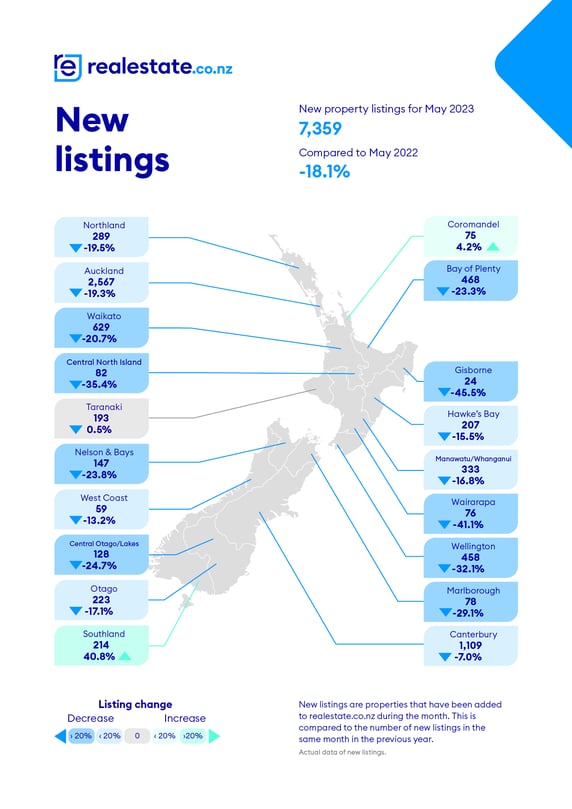

Lowest autumn on record for new listings – near lockdown levels

The number of new listings coming onto the market in May were at a 16-year low, with autumn listings dipping almost to the same level we saw during the 2020 lockdown.

The combined total of new listings coming onto the market nationally during March, April, and May (autumn) this year was just 23,743.

"This is only just above the 21,391 new listings that came onto the market during the same period in 2020 when restrictions, at times, meant vendors couldn't list their homes even if they wanted to," says Vanessa.

Comparatively, there were 18.2% more listings during autumn in 2022 than in 2023.

"We typically see around 30,000 new listings added to the site between March and May and have done so for the last 16 years, so this is a significant drop," says Vanessa.

She explains that the low listing numbers are likely a symptom of uncertainty in the market:

"Kiwis are known for delaying buying and selling decisions during times of uncertainty. And from interest rates to who will be in government next term – things are difficult to predict right now."

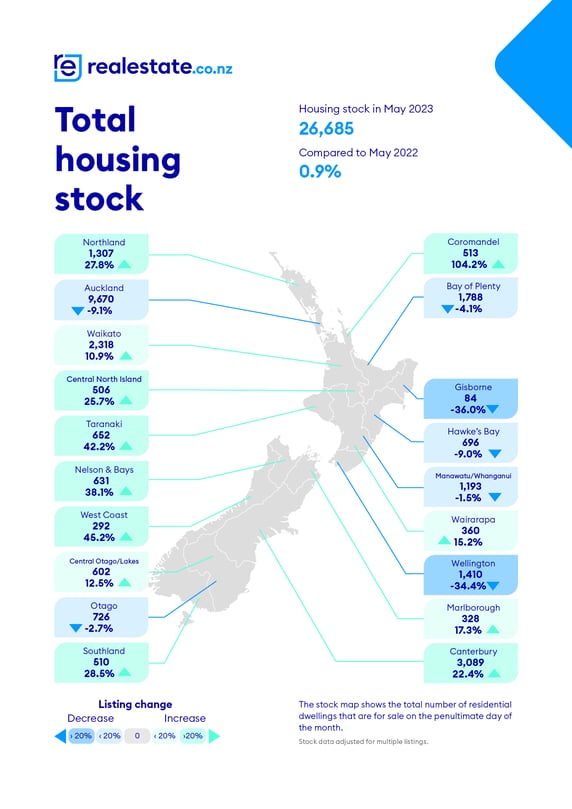

Stock beginning to level out

Seven of 19 regions saw stock decrease year-on-year during May, indicating that the ballooning stock levels we've seen over the last 12 months could be easing.

The total homes available for sale were down by 36.0% in Gisborne, 34.4% in Wellington, 9.1% in Auckland, 9.0% in Hawke's Bay, 4.1% in Bay of Plenty, 2.7% in Otago, and 1.5% in Manawatu/Whanganui. Nationally, stock levels were flat year-on-year, with a marginal increase of just 0.9%.

Vanessa says it wasn't uncommon to see stock levels double year-on-year during 2022 and early 2023, as the slow market allowed buyers to take their time and forced sellers to be patient:

"While we aren't quite back to 2020 levels where stock was low across the board and the market highly competitive, this looks to be the beginning of a market shift."

The levelling of stock could eventually impact average asking prices as supply inches closer to demand.

Coromandel did buck the trend with a year-on-year increase of 104.2%, but Vanessa explains that this small market tends to see numbers fluctuate. All other regional stock increases were below 50.0%.

For media enquiries, please contact:

Hannah Franklin | hannah@realestate.co.nz

About realestate.co.nz

As New Zealand’s longest-standing property website, realestate.co.nz’s mission is to empower New Zealanders with a property search tool they can use to find the life they want to live. With residential, lifestyle, rural and commercial property listings, realestate.co.nz is the place to start for those looking to buy or sell property.

Whatever life you’re searching for, it all starts here.

Want more property insights?

- Market Insights: Search by suburb to see median sale prices, popular property types and trends over time.

- Sold properties: Switch your search to sold to see the last 12 months of sales and prices.

- Valuations: Get a gauge on property prices by browsing sold residential properties, with latest sale prices and an estimated value in the current market.

Glossary of terms:

Average asking price (AAP) is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released simultaneously.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. The site reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Stock is the total number of residential dwellings that are for sale on realestate.co.nz on the penultimate day of the month.

Inventory is a measure of how long it would take, theoretically, to sell the current stock at current average rates of sale if no new properties were to be listed for sale. It provides a measure of the rate of turnover in the market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

01 Jun 2023