However, the data suggests a cooling in the market, not a crash.

Inflation, interest rate hikes and speculation of a property market crash are enough to make homeowners nervous – especially if they are looking to sell.

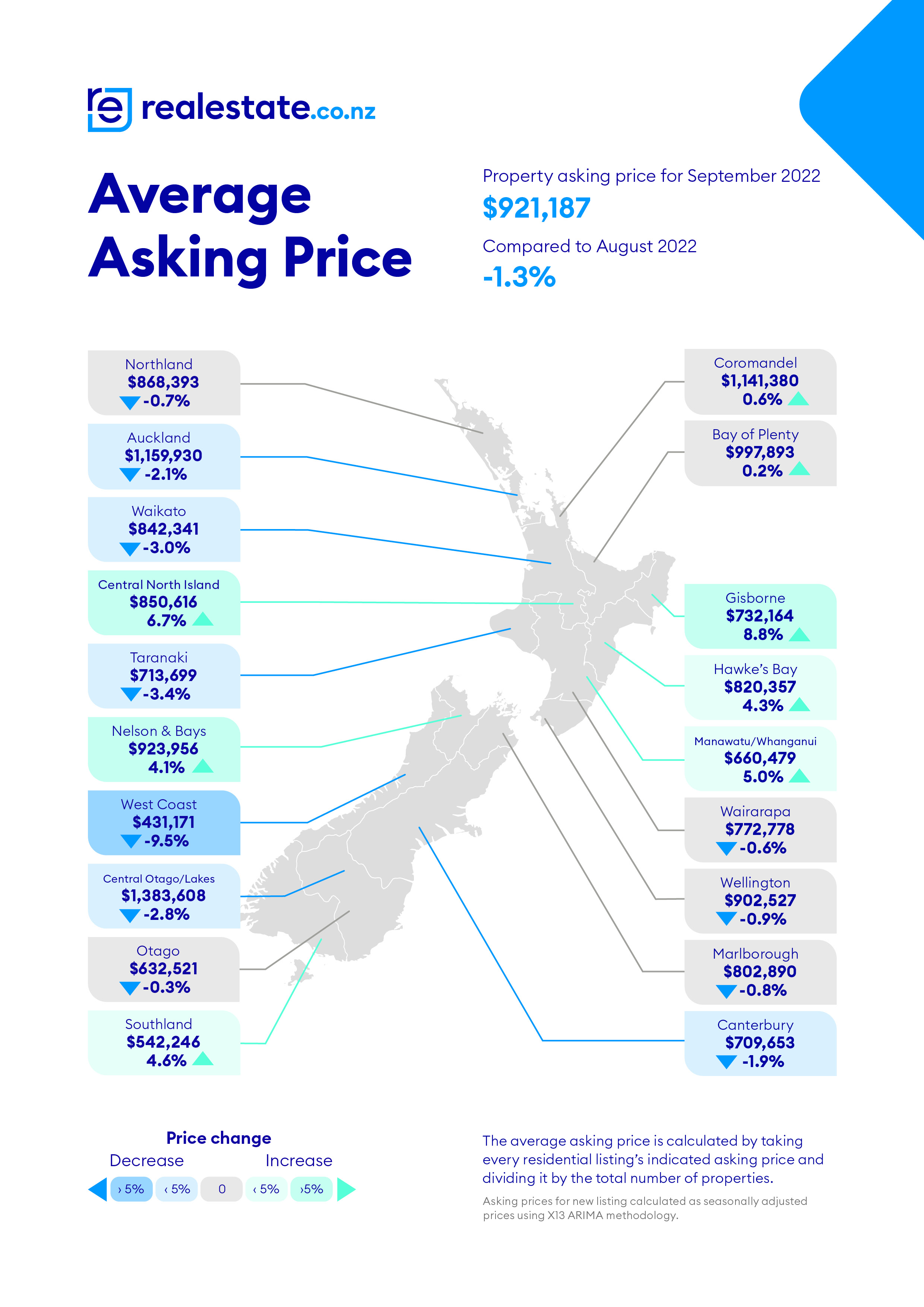

But the latest data from realestate.co.nz shows that despite there being buyers’ markets nationally and in three regions, average asking prices haven’t dropped significantly. Year-on-year, prices were up or stable in all except two regions.

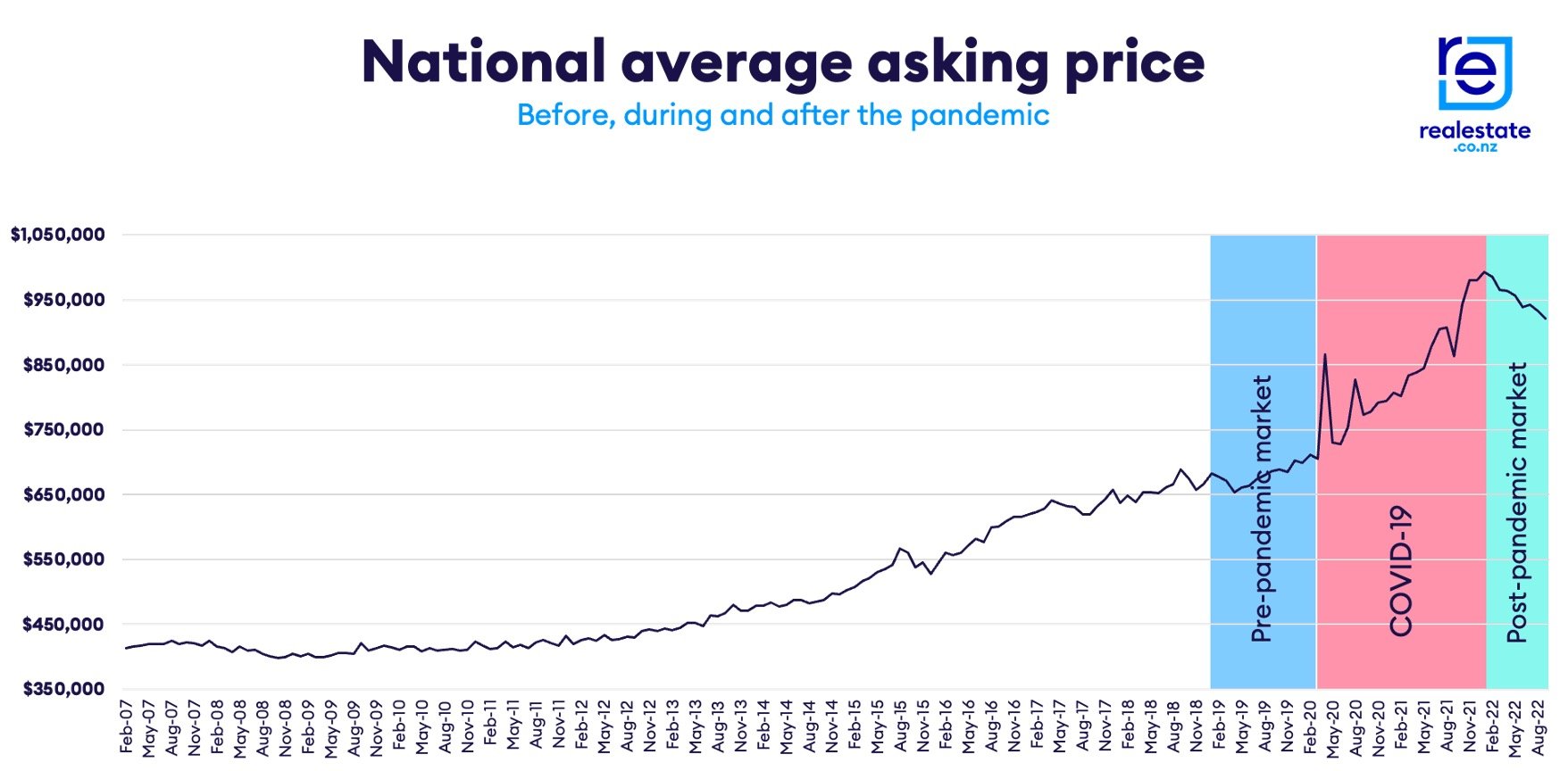

And since the national average asking price peaked in January at $992,659, it has only decreased by 7.2% to $921,187 in September 2022.

Vanessa Williams, spokesperson for realestate.co.nz, says the market is cooling rather than crashing:

“The national average asking price has decreased by around $10,000 per month since January. If this cooling continues at the same pace, the national average could be around $890,000 in December.”

However, Vanessa explains that while this speculation might sound scary for property owners, it’s essential to consider these changes in context and remember that property is generally a long-term investment:

“Even if prices continue to trend down until Christmas, it only takes asking prices back to mid-2021 levels – a time when prices in the late $800s were all-time highs.”

She adds that the market is cyclical and suggests this is a levelling out of the market following the pandemic’s disruption over the last two years.

A good time to buy property in Auckland?

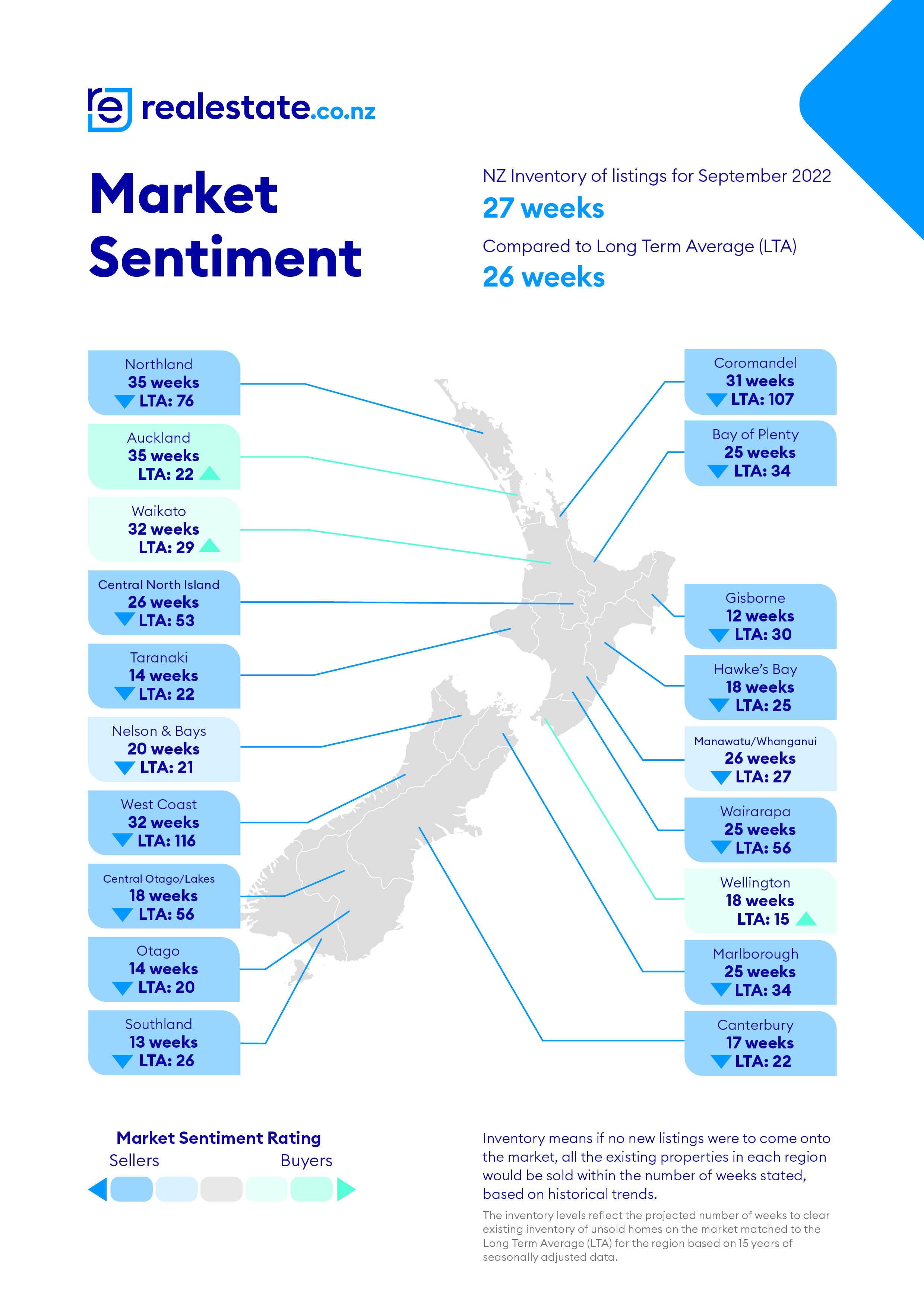

Auckland, Waikato, and Wellington continued to favour buyers last month. Nationally, New Zealand tipped into a buyers’ market in September. Other than July this year, this is the first time that New Zealand has moved into a buyers’ market in a decade.

In Auckland, the regional rate of sale was 59.1% slower than the 15-year average during September. Vanessa says this could make it a good time to buy in the region.

“While a buyers’ market doesn’t necessarily mean bargain basement prices, a slower market gives buyers more time to do their due diligence when searching for their ideal property,” says Vanessa.

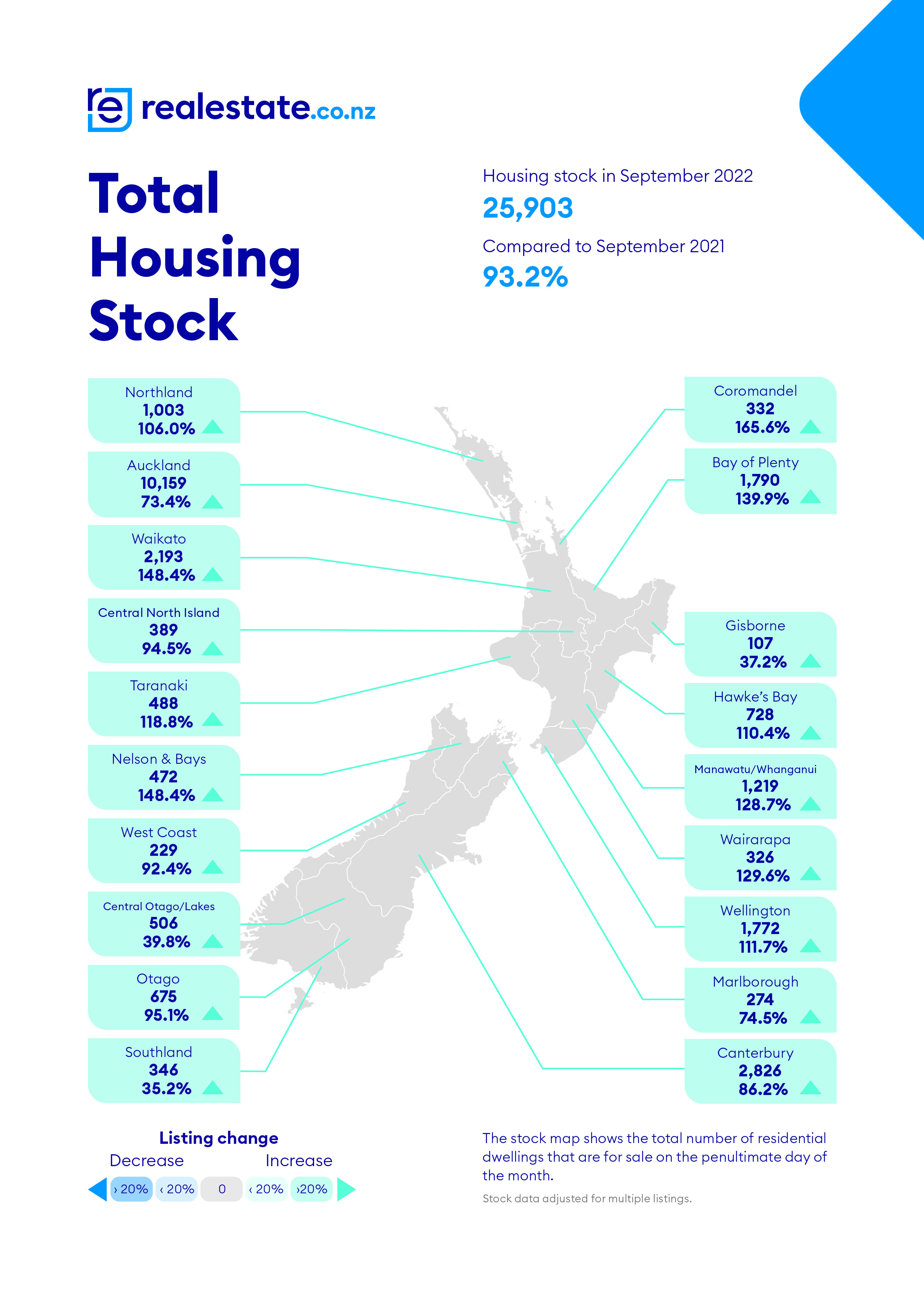

Stock levels in the Auckland region were up 73.4% compared to the same month last year.

“There were more than 10,000 properties for sale in the Auckland region last month, so there are plenty of opportunities for buyers to find a home that fits their lifestyle,” says Vanessa.

In a less competitive market, both vendors and buyers have the time and space they need to negotiate to get the best outcome for both sides, Vanessa adds.

New listings ‘spring’ up in September

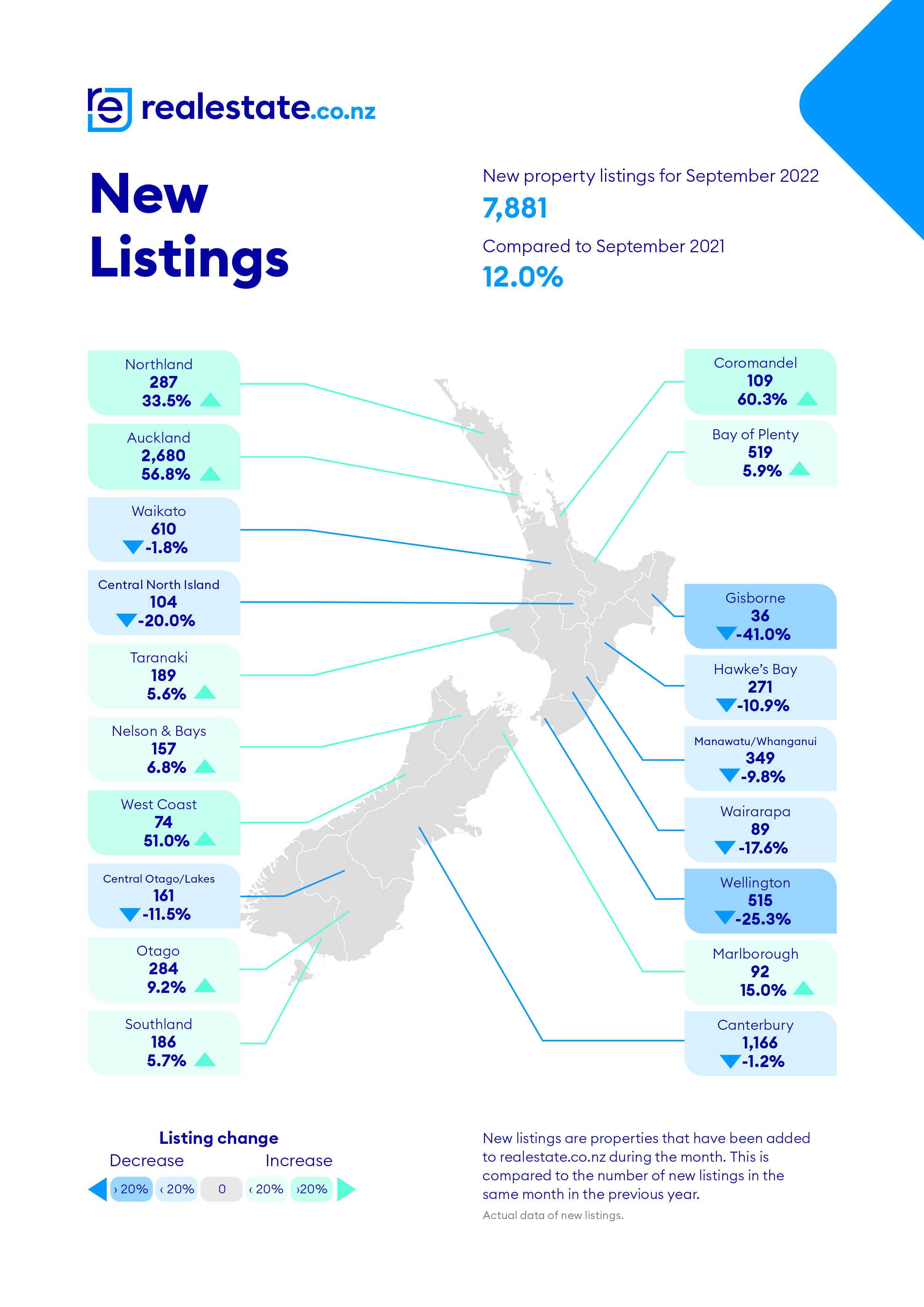

Many Kiwis were facing COVID-19 restrictions this time last year, so it’s not surprising that new listings were up nationally by 12.0% last month compared to September 2021. However, compared to pre-pandemic levels in September 2019, 1,020 fewer homes came onto the market in September 2022.

Vanessa says that better weather and the desire to change living arrangements ‘before Christmas’ typically means an increase in new listings during spring.

“We’re not quite up to pre-pandemic levels when it comes to new listings, however. 1,020 fewer homes came onto the market in September 2022 than in September 2019.”

“Perhaps Kiwis were busy making the most of the extra daylight and the long weekend to prep their homes for sale during September this year,” suggests Vanessa.

Stock levels more than double in 10 of 19 regions

Stock levels were up year-on-year in all regions during September, with 10 regions seeing stock more than double and another four regions increasing by more than 85%.

“Buyers are spoilt for choice right now, and the high stock levels contribute to market sentiment favouring buyers in some of our regions.”

“The good news is buyers are more likely to find a property that supports the life they want to live now than they were a year ago,” says Vanessa.

For media enquiries, please contact:

Ashley Harder | 021 712 210 | ashley@realestate.co.nz

About realestate.co.nz

As New Zealand’s longest-standing property website, realestate.co.nz’s mission is to empower New Zealanders with a property search tool they can use to find the life they want to live. With residential, lifestyle, rural and commercial property listings, realestate.co.nz is the place to start for those looking to buy or sell property.

Whatever life you’re searching for, it all starts here.

Glossary of terms:

Average asking price (AAP) is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released simultaneously.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. The site reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

03 Oct 2022