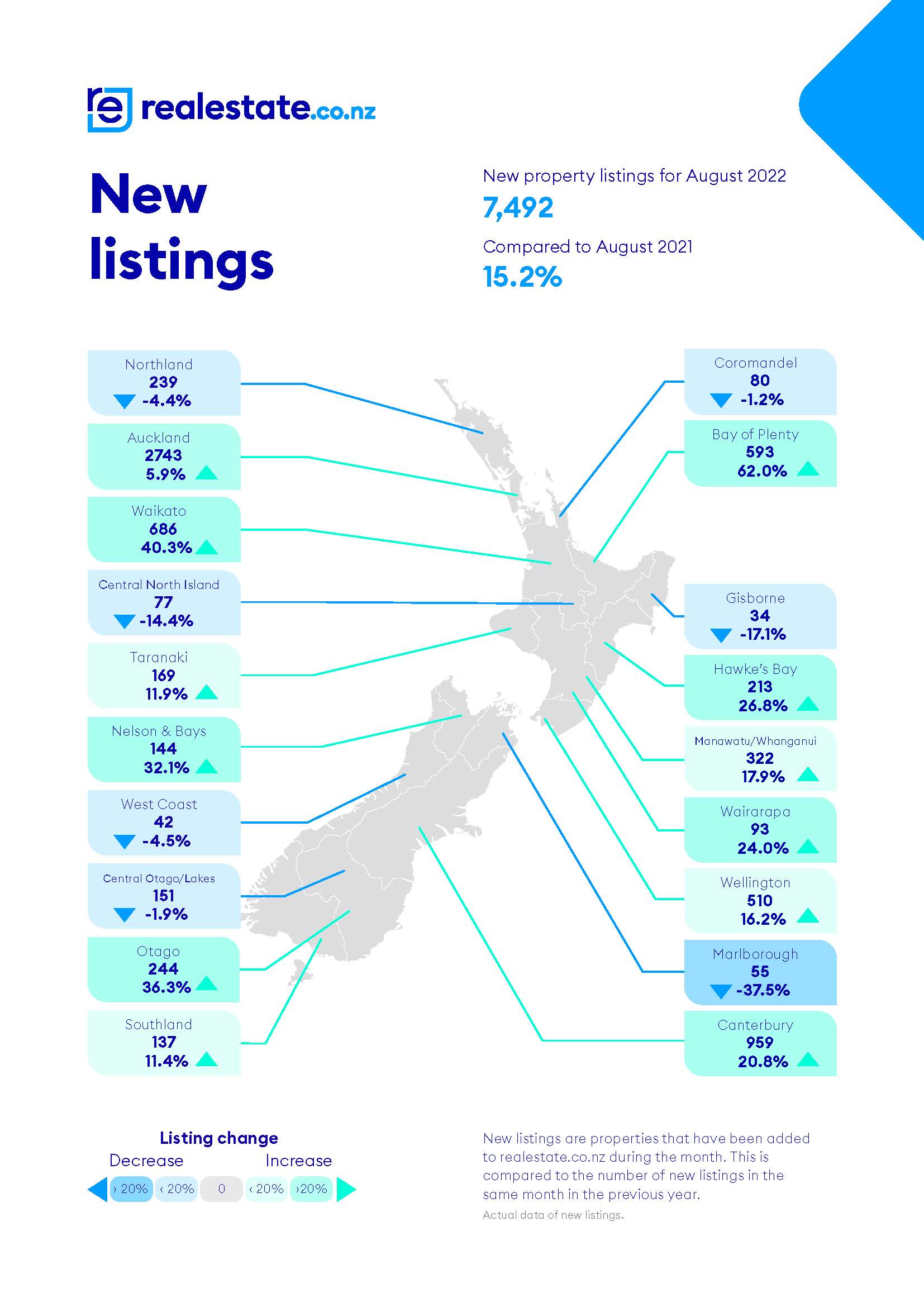

The latest data from realestate.co.nz suggests the cooling housing market is offering plenty of choice for buyers in August, having an impact on average asking prices across eight regions. Vanessa Williams, spokesperson for realestate.co.nz, suggests this has been on the horizon for a few months.

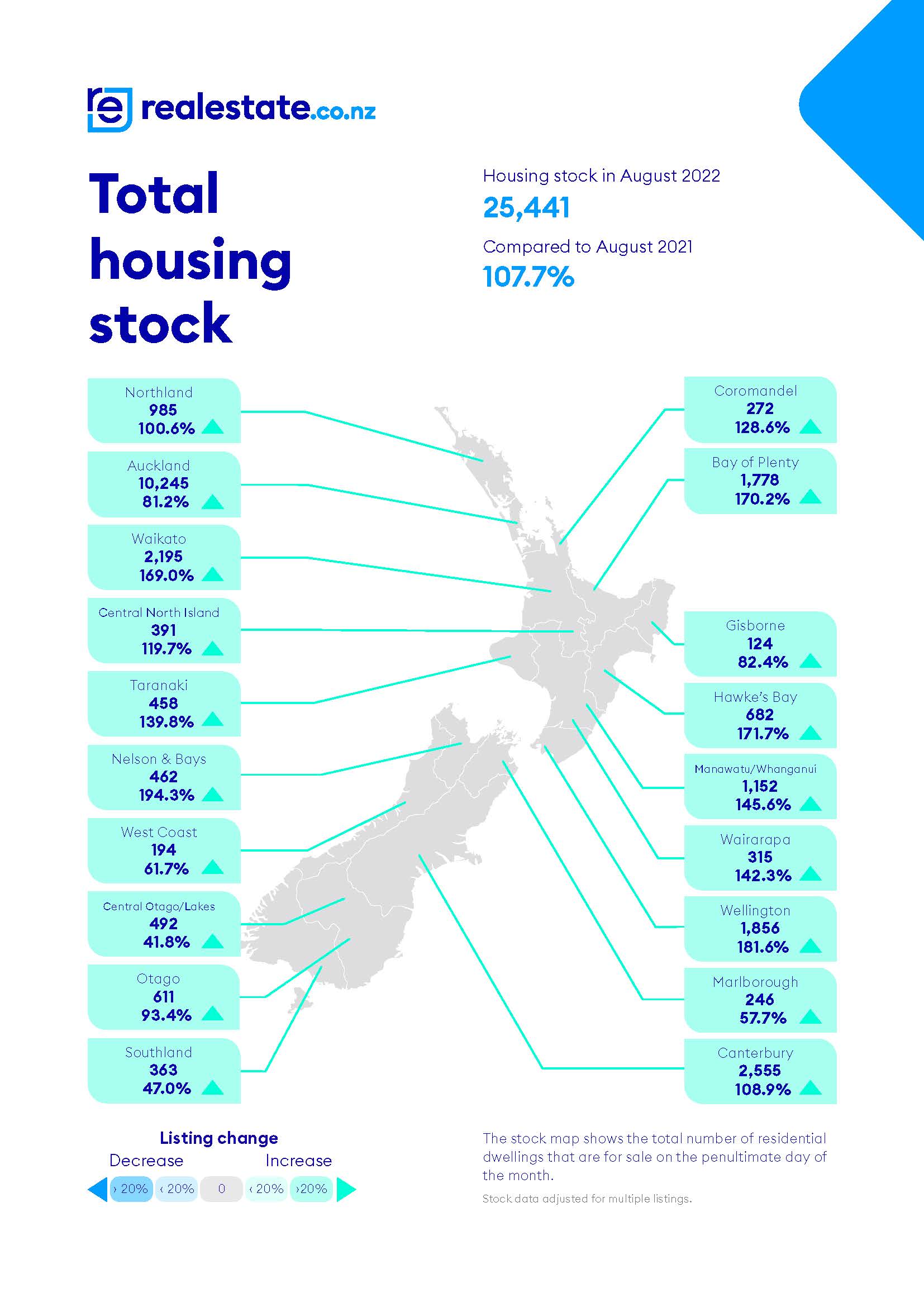

“In August last year, our data reported the lowest housing stock in our 15-year history. Fast-forward to today, and we’ve seen stock double year-on-year, which is starting to be reflected in asking prices,” said Vanessa.

“We’ve seen this coming for a few months, and there has been plenty of speculation about downward trends in the market. But instead, we’ve seen a slow stabilisation of the unprecedented market we witnessed during the pandemic.”

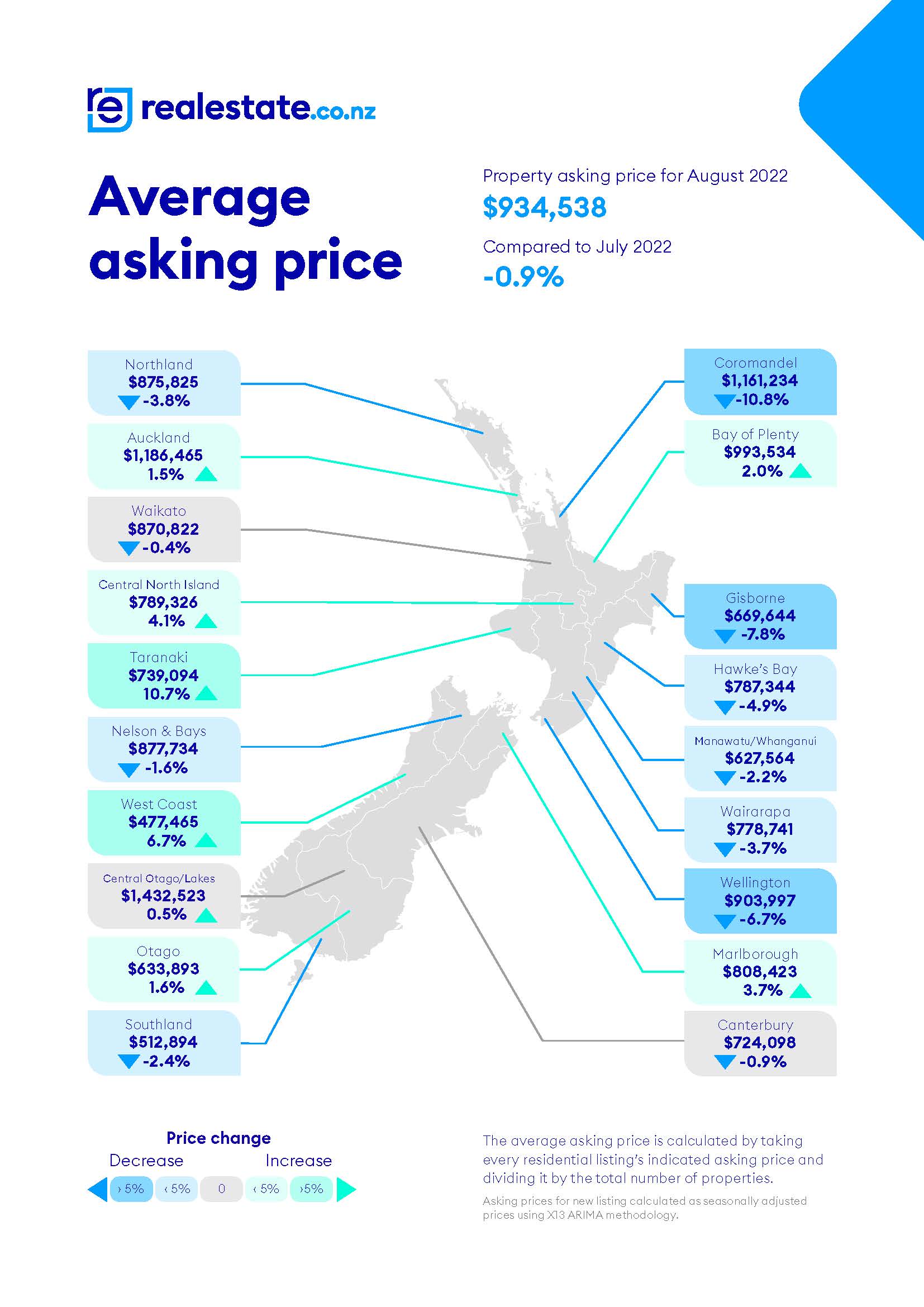

When compared to August 2021, Wellington (down -6.0% to $903,997), Hawke’s Bay (down -3.1% to $787,344), Manawatu/Whanganui (down -1.6% to $627,564), Nelson and Bays (down -0.7% to $877,734), Auckland (up 0.4% to $1,186,465), Northland (up 0.7% to $875,825), Southland (up 1.1% to $512,894), and the Coromandel (up 1.1% to $1,161,234), all saw their average asking prices either cool or remain stable.*

“While these regions have seen cooling asking prices, it’s important to note that across the board, asking prices have been a mixed bag. Two regions—Taranaki and the West Coast—hit 15-year record highs in August, increasing 24.1% and 16.8%, respectively,” said Vanessa.

*realestate.co.nz identifies figures between -1.5% - +1.5% as stable.

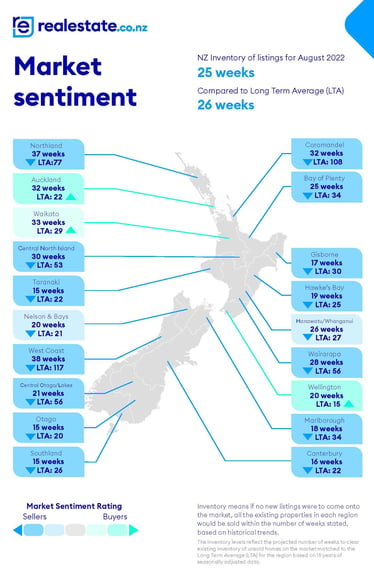

The Waikato region joins Auckland and Wellington as a buyers’ market; two regions dip back into the sellers’ favour.

Last month, realestate.co.nz reported that Waikato showed signs of tipping into a buyers’ market. This month, the region joined Auckland and Wellington in giving property seekers the edge.

“If you’re looking to buy a home near Hobbiton this month, you’ll have far more luck now than in 2021,” said Vanessa.

However, Hawke’s Bay and Gisborne, previously in buyers’ markets, tipped back into the sellers’ favour in August. Vanessa suggests that if you’re feeling a bit of whiplash, it’s likely due to the market’s cyclical nature.

“As the market continues to shift, we’ll likely see these rises and dips in market sentiment across the country. These shifts are likely to continue as we head into the warmer months of spring.”

What’s happening in Auckland?

New Zealand’s largest city followed Wellington into a buyers’ market this April. After hitting a 15-year record high of $1,277,353 in January 2022, Auckland’s average asking price has cooled by 7.1% since, landing on $1,186,465 in August, allowing for seasonal adjustment.

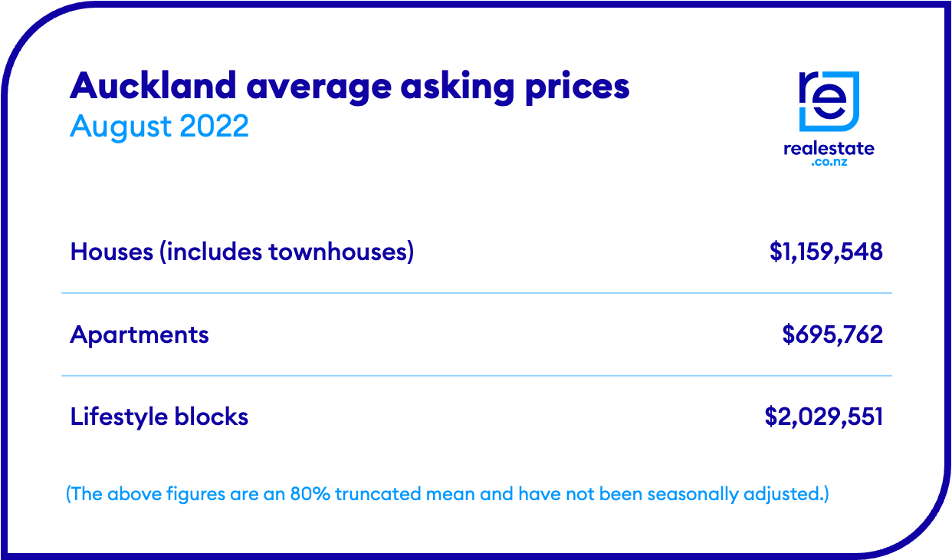

“As we dig deeper into the data, we learn that the property types seeing the greatest impact of the buyers’ market and rising housing stock were apartments and lifestyle blocks. Year on year, average asking prices for apartments dipped by -9.9% to $695,762, and lifestyle blocks dipped by -5.1% to $2,029,551,” said Vanessa.

Asking prices for standalone homes and townhouses appeared to hold their ground last month, though, at $1,159,548—up 0.6% year-on-year.

For media enquiries, please contact:

Ashley Harder | 021 712 210 | ashley@realestate.co.nz

About realestate.co.nz

As New Zealand’s longest-standing property website, realestate.co.nz’s mission is to empower New Zealanders with a property search tool they can use to find the life they want to live. With residential, lifestyle, rural and commercial property listings, realestate.co.nz is the place to start for those looking to buy or sell property.

Whatever life you’re searching for, it all starts here.

Glossary of terms:

Average asking price (AAP) is neither a valuation nor the sale price. It is an indication of current market sentiment. Statistically, asking prices tend to correlate closely with the sales prices recorded in future months when those properties are sold. As it looks at different data, average asking prices may differ from recorded sales data released simultaneously.

New listings are a record of all the new residential dwellings listed for sale on realestate.co.nz for the relevant calendar month. The site reflects 97% of all properties listed through licensed real estate agents and major developers in New Zealand. This description gives a representative view of the New Zealand property market.

Seasonal adjustment is a method realestate.co.nz uses to represent better the core underlying trend of the property market in New Zealand. This is done using methodology from the New Zealand Institute of Economic Research.

Truncated mean is the method realestate.co.nz uses to supply statistically relevant asking prices. The top and bottom 10% of listings in each area are removed before the average is calculated to prevent exceptional listings from providing false impressions.

01 Sep 2022